It’s a great day to be alive!

Let’s give this article a soundtrack:

What am I so happy about? How about making $9,596 in six months with close to zero work!

Owning rental properties sure can be glorious. My portfolio is skating along nicely right now. Of course, it does take some setting up and you do have to put in a lot of time and energy in the beginning, not to mention it can be quite a hefty investment. If you’re starting a property business, you can get a business cash advance to help you cover the costs of any materials you may need or anything else, like legal documentation ad whatnot.

Let’s dig into how I got to this point and the latest numbers.

A Little Work Several Years Back

I earned $9,596 with little effort because I put in the effort to purchase the properties a few years back.

But it wasn’t a ton of work… I purchased turnkey, fully rehabbed properties on the other side of the country. I still haven’t seen them. Most the effort was getting educated and developing the right mindset to take action.

Then I sat back and relaxed.

I own two rental properties.

The first is in the Atlanta area, purchased in 2011 for $81,500. After closing costs, my initial investment was just $19,936.

The second property is in the Memphis area, purchased in 2014 for $93,000. My initial investment was $24,030. Many people who are looking to buy more than one property will consider a let to buy mortgage so that they can let out one property to buy the second. It can be a profitable venture but should certainly be considered in full before any decisions are made.

A little money, a little effort, but now I get to sit back and collect checks.

The Last 6 Months

The big news was finishing a cash out refinance on property 1.

The property appreciated so much, I was able to refinance it and get a check for $36k. Significantly more than my initial investment! BOOM!

See: Cash Out Refinance on a Rental Property – My Actual Numbers

I spent 6 to 8 hours on the phone with lenders, gathering documents, and signing lengthy contracts.

Even though I have this huge chunk of cash, I haven’t put it to work yet. It is just sitting in a savings account until I purchase my next rental.

So temporarily, this move actually hurt my bottom line. It cost about $2k in closing costs to access this money.

It’s all about the long game though. I’m setting up for even more profits in the future, as that cash equals the down payment on one and a half more rental properties!

More on this later, let’s look at the numbers first.

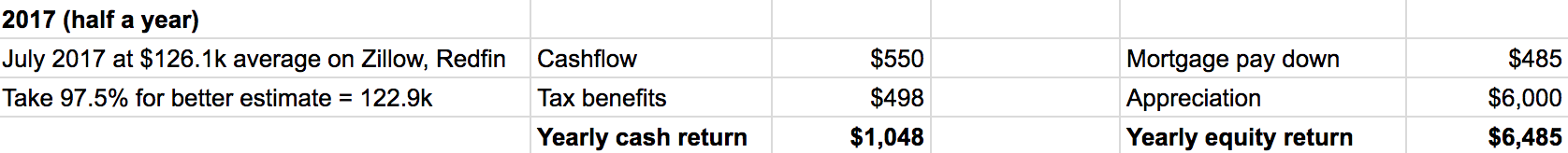

Property 1 Numbers

Even though the property just appraised for $130k, I decided to be conservative with a $123k value in my estimate.

That’s still up $6k. A thousand dollars a month straight to my net worth!

Add in $1500 more for the tenant paying down the mortgage, cash flow, and tax benefits.

In six years, the total return of this property has been $55k. On an initial investment of $20k. You kidding me!?!?

Compounded rate of return of 25% a year.

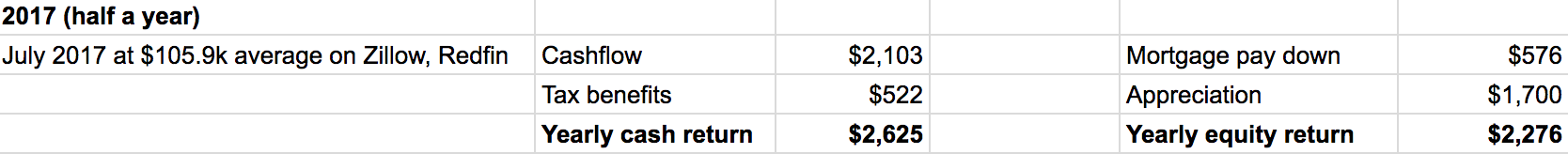

Property 2 Numbers

Appreciation here has been more modest, as expected. Memphis is an even more linear market than Atlanta. Flatter peaks and valleys.

The Zillow estimate actually went down, but I average it with Redfin and make small adjustments. The result is $1700 of appreciation in the last six months.

Big cash flow of $2k plus another $1k from the tenant paying down the mortgage and tax benefits.

In 3 years the total return is almost $17k.

Compounded rate of return of 19% a year. Not as good as the other, but pretty darn impressive.

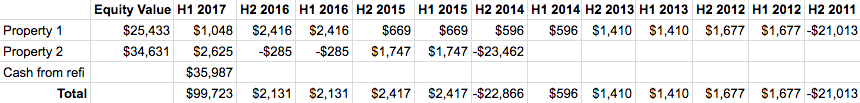

Overall Portfolio Numbers

Those numbers don’t tell the whole story though. It is more accurate to do a cash flow analysis.

When you have an asset that spits off cash in addition to going up in value, it matters when you get that cash.

$1k received six years ago is more valuable than $1k received today. I can invest it and make extra money over that time. That’s what a cash flow analysis accounts for.

Usually it is done monthly or yearly. As a happy medium between accuracy and simplicity, I opted to look at 6 month chunks of time. I used a discount rate of 2% per half year (basically what I think the money should earn pretty risk free).

So what has the portfolio earned over the last six years?

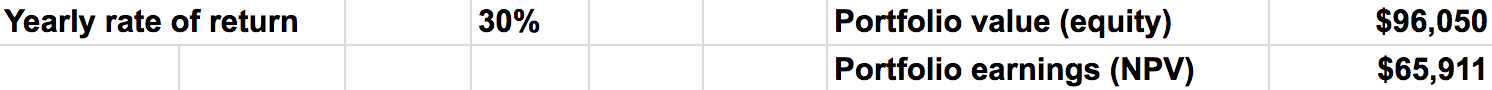

30% yearly return!

I’ve earned $66k in that amount of time. Between the equity in the two properties and the refi cash waiting to be invested, the portfolio is worth $96k!

It Never Gets Old

Aren’t those numbers exciting? Who is having fun here?

Now for a dose of perspective.

The biggest driver of return has been appreciation. I don’t believe this current run is sustainable.

My Atlanta property has appreciated 8% a year over the 6 years! That is incredible, but over a whole real estate cycle, I would expect it to settle closer to 3%.

See: How to Visualize the Real Estate Cycle

I’m not worried about it though. Even with 3% a year appreciation, basically the same as inflation, an investor can make a killing.

How? You only have to put 20% down and get 100% of the benefit. Multiply that 3% by 5 and you get 15% a year return from appreciation alone. You certainly won’t hear me complaining about that!

See: The Thing Most Investors Don’t Understand about Leverage

That was a dose of pessimism, now one more reason for excitement looking forward.

Each individual property has done well, but there really hasn’t been any compounding effect yet. I want exponential growth!

The only thing remotely exponential so far was that I used the $7k in cash flow over the first 3 years of property 1 towards purchasing property 2. Not a big effect considering that was less than a third of the initial investment.

But now?

Property 1 cloned itself and then some. The proceeds from just the cash out refinance will allow for the purchase of another rental property and a half. Add in the cash flow and it has earned enough for two more rentals!

See: Let’s Double Down! Cash Out Refinance on a Rental Property

Double the cash flow, double the mortgage pay down, double the appreciation, double the tax benefits.

Wish You Started 6 Years Ago?

Too late for that, the next best thing is to start right now.

Do you think I possess some special skill or luck that you wouldn’t be able to replicate?

How can you learn just enough, limit your downside, and purchase your first rental?

What’s holding you back from getting started or adding to your portfolio?

I want to hear from you!

If you want to dig deeper into the numbers, the full spreadsheet is available here.