How long can you hold your breath for?

Most haven’t done it since they were kids, when we dipped under the water and to see who could stay down the longest.

Really safe kids… it might be smarter to go play in the street.

Breathing is natural. It is what we want to do, we have to force ourselves not to.

For a rental property investor, acquiring properties is like breathing.

I’ve waited patiently for 3 years since buying my last rental. Now it is time to shop for rental number three!

Why the Long Wait?

I was living life my man.

My goal in rental property investing is to put my money to work for me. Fairly passive returns – with a bit more work that index funds, I believe I can earn closer to 20% a year.

My approach requires money to invest. 20% down on a $100k property requires around $20-25k.

Of course, there are ways to get into real estate without money. Plenty of people do it, but that is more of a job, but you can find tips online that could get you started. For instance, you can check out these tips on investing in Costa Rica property. However, it is different for each place you decide to invest. Hustling to create something out of nothing. Like getting a deal under contract and handing it to someone with money. The property you invest doesn’t simply have to be a house. You may decide that you want to do something like invest in a supermarket instead, especially if you can purchase such a property from an expert management business that has connections within the supermarket industry.

How does someone absolutely pumped about investing in rental properties only own 2 after 6 years?!

The first three year gap I left my job at 25 years old, traveled for 6 months to amazing places like New Zealand, Costa Rica, and Tahiti. Then I got back and bootstrapped my business giving kid coders a personalized and fun chance to keep learning over a much longer time frame than anywhere else.

Does it look like I regret that decision?

Little did I know then, that Memphis purchase three years ago would be the beginning of another long gap.

Just around the corner was an even more important and expensive life milestone. I somehow wooed an amazing woman and got married!

But now it is time.

Using the Proceeds of My Cash Out Refinance

The people who don’t understand the benefit of owning rental properties look at the return in year 1.

A couple hundred dollars a month in cash flow, hardly worth the hassle right?

We know better than that. Look at it over a couple decades.

One of the things that makes it so crazy awesome over a long time horizon is the ability for your properties to clone themselves.

See: Let’s Double Down! Cash Out Refinance on a Rental Property

After 6 short years owning my Atlanta property, I was able to refinance and turn $36k of equity into cash.

See: Cash Out Refinance on a Rental Property – My Actual Numbers

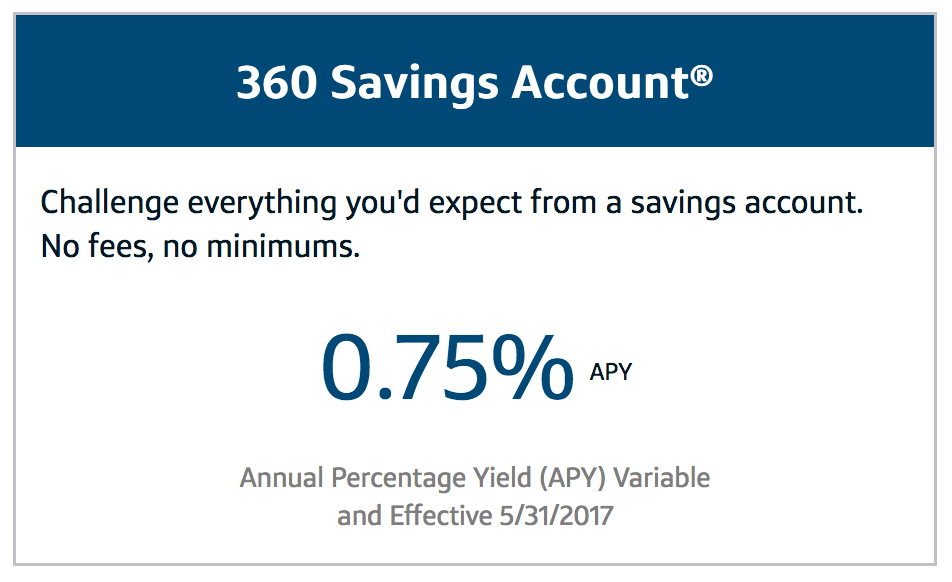

That money is currently sitting in a high yield savings account, waiting to be put to work.

(Yes, 0.75% is high yield these days…)

Starting the Search

One of the most important steps is to figure out the city to focus on.

There is a range of markets for investors that make sense at various times. Given where we are in the cycle, things are pretty expensive, I want a more conservative market. Low-cost cash flow.

See: How to Visualize the Real Estate Cycle

Since I already have a property in Memphis, I’m going to start my search there. That way I would have fewer property managers to work with. If the numbers don’t work, I will expand to compare to other cities like Indianapolis or Kansas City.

When I find potential properties I will also check them thoroughly. Structural issues might cause extra expenses that could be undesirable. If I found a house with an issue such as a roof that needs to be changed or fixed then I might consult a company similar to a roofing company in Denver or a local expert to get an idea of potential costs, and weigh up the value of the house overall.

I’ll also consider the neighborhood my current property is in. I’m not as committed to the specific neighborhood, so I’ll more thoroughly compare various areas.

For example, some friends of mine have just purchased a property in Wayne in Philadelphia after browsing a few different properties on the Main Line Homes real estate website. It is always worth speaking to any friends who have recently purchased a property as they can tell you more about any ongoing real estate trends in their area.

Reviving Old Contacts

I worked through Jason Hartman’s company for my first two properties. They are a national marketer of turnkey properties, working with local providers in each market, and providing investors a counselor to work with.

They get a referral fee when you purchase a property, you get help along the way, their contacts, and a little bit more oomph behind your purchase (you are part of a group with some scale, not a one-off investor local providers can screw over).

Pretty cool business model for beginner investors or people who highly value their time. The other big company with the same model is Norada. I’ve connected with a counselor over there who was very knowledgeable, but went with my Jason Hartman counselor due to our earlier success.

I also got in touch with the local provider in Memphis who I purchased from three years ago. They are still plugging away, doing 60-90 flips to investors a year.

They are just one of several Memphis providers Jason Hartman’s company recommends right now, so I got an introduction to a couple others as well.

How it Works in 2017

The investor market is hot. Properties are moving much more quickly than when I purchased three years ago.

There is likely close to zero wiggle room on pricing for these turnkey properties. If you don’t pay it, someone else likely will.

It is important to have the pre-approval in place from the bank. If you don’t, they aren’t going to hold up and wait for you.

You also have to be on the radar of these providers. They should know what you are looking for so they can let you know when something is coming through the pipeline. Investors aren’t waiting for the rehab to be 100% finished before putting the property under contract. If you are, the deal is going to someone else.

Prices are a little bit higher than a few years ago, but the 1% rule is still achievable so the numbers make sense. If I couldn’t get right around 1% of the purchase price in rent per month, I would look at other markets.

I’ll be picky with my property, but ready to move on a moments notice.

It’s Exciting to Be Back!

I’m jazzed to be adding to my portfolio again.

Hopefully it will be a more regular occurrence from here.

What do you think? Is now a good time to buy in a low-cost cash flow market like Memphis? What else should I consider?

What would be valuable to hear about my process?