Cool as a cucumber

That pineapple is way cooler. Coolest? A pile of tax free money thanks to a cash out refinance.

Who doesn’t love a pile of free money?

Imagine you won $26k in some sweepstakes. How excited would you be? So pumped! You immediately start dreaming up all the things you are going to buy… how much do those water jet packs cost?

Then your friend Debbie, who is always a downer, warns that you’ll have to pay taxes on the winnings. So you will really only receive $15k. Ouch.

What if there were a way to get a pile of money that you don’t owe taxes on? Enter the cash out refinance.

What is a Cash out Refi?

When you refinance a mortgage, you are signing up for a new loan that will replace your old one.

If the amount you own on the old mortgage is less than the new loan balance, you can keep the rest. Since you are turning equity into cash, it is called a cash out refinance.

You might wonder, why isn’t this taxed?

Well you aren’t actually gaining anything – you are turning one asset (equity) into another (cash), while your loan balance increases. Net it is a wash.

Or put another way, you aren’t taxed on money you receive on a loan. In fact, since this is a mortgage, you might even get tax benefit with a mortgage interest deduction!

Rental Property Example with Numbers

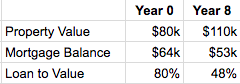

Eight years ago you went through the slight hassle of purchasing a rental property.

The purchase price was $80k and you put 20% down, so your initial mortgage was $64k.

Then it was smooth sailing. The tenant paid the mortgage for you, while you went about your life.

Today the mortgage balance is $53k.

The value of the property also increased to $110k. You were expecting about 3% a year appreciation, keeping pace with inflation, but you got a little lucky with 4%.

Pretty solid build up over 8 years! As a percentage, the loan is 48% of the value of the property.

You have a lot of equity in the property, but that equity doesn’t earn any extra return. Wouldn’t it be great to put that money to work?

The Numbers After a Cash Out Refi

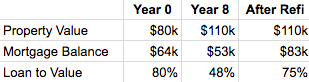

Current rules allow for a 75% loan to value ratio on a cash out refinance.

So you would be starting a new 30 year mortgage with an $83k balance.

You get a new loan for $83k and you owe $53k on the original loan. So you pocket $30k minus the costs of doing the refi, which may be around $4k.

$26k tax free!

Your mortgage payment will go up slightly, but if you have been able to successfully raise the rents, the tenant will still pay it. You wouldn’t do a cash out refinance unless you can still get monthly cashflow on the property.

How to Spend the Money?

You could go on a huge shopping spree, but I like to think of my rentals as a portfolio. I reinvest the earnings from cashflow and equity.

If your property is $110k, I bet others in the neighborhood are $110k too.

If you put 20% down on a new property with $4k in closing costs, it comes to exactly $26k out of pocket. That number sure sounds familiar…

You took the equity from property 1 and used it to get property 2. The first property cloned itself.

In the short term, your net worth suffered as a result of the $4k refi and $4k in closing costs for the new property. But how do things stand in the long run? Well! To begin, you should thoroughly understand any additional costs – closing costs – you may have to bear while dealing with a property by visiting websites such as https://sharonsteelerealestate.com/nj-closing-costs/. This is because it can have an impact on both your short and long-term financial management. When you are aware of all possible outcomes, you can make better decisions.

Projecting Into the Future

Now you are the proud owner of two rental properties. Ballin’!

With the impressive returns on rental properties, what can you conservatively predict?

Each year, for each property:

- $1k in cashflow after all expenses

- $3.5k in appreciation (roughly 3% a year, same as inflation)

- $1.5k decrease in the mortgage balance the tenant kindly pays for you

- Plus tax savings we won’t include here to keep it simple

- Sign up for the email list for the complete breakdown of these numbers

With two properties your overall return is $12k a year. You doubled the amount you earn each year!

Since the second property didn’t require any additional investment, your portfolio only required the $20k eight years ago ($16k down, $4k in closing costs).

Put another way – eight years ago you paid $20k and now your net worth goes up $12k every year!

Do you see how powerful this is?

Starting This Process with My First Rental

I’m currently talking to lenders about a cash out refinance on my Atlanta rental. It has only been 6 years, but my calculations indicate now is a good time.

I’ll share the complete numbers soon, but they are fairly similar to the example above.

When I’ve written about this topic before, people have objected to paying $4k in refi costs to get $26k back. That is a whopping 15% fee!

In my opinion this is stingy – who cares what someone else makes money off me as long as I get mine? This is a win-win situation.

It is also short term thinking – yes there is a hit to your net worth, but you have doubled your earning potential! Project a decade in the future and the right decision is obvious.

I want to hear what you think. Is the fee too much for the tax free lump of cash in a cash out refinance? Do the benefits outweigh the costs?

I came across your blog on financiallyalert.com. I’m also interested in rental property, so it’s great to be connected to your blog!

Welcome! I love Michael’s site at financiallyalert.com. Do you have any rental properties yet?

And congrats on starting a blog!

I think it all looks good on paper. In my admittedly anecdotal experience, the devil is in the details.

The property my wife bought (before I met her) in 2002 is worth about 15% less than what she paid for it. That was a good deal before the bubble reached it’s zenith. So it could be 15 years with negative appreciation. The property I bought in 2004 is worth 20% less than what I paid for it. Maintenance costs add up over 15 years.

These properties are in a relatively good real estate market outside of Boston.

I think you should have a very good emergency fund to cover the maintenance. If you have more properties that’s likely a bigger emergency fund. That’s money that might not be earning much interest. So there’s a cost there too.

I’m typically an aggressive investor, but I like the idea of eliminating the mortgage so that all the income from the property (after taxes, insurance, and maintenance) is profit. Maybe that’s 10K a year on a property like this. It’s real cash that you can spend just like your cash out refinance.

I’d like to see this taken out over a few iterations with some modest downturns and maintenance stuff mixed in. I’d also be curious if lenders are willing to lend to you after you finished a cash-out refinance. It seems like your risk profile would go up with something like $160K in mortgages and something like $40K equity (these numbers might not be accurate, but you get the idea).

Here’s another thought. What about a 1031 exchange to unlock that equity into something like a duplex?

Those could be a couple of bad decisions,

Yes – a 1031 exchange is another approach to the same end of putting equity to work. You can swap into a duplex or even two other SFHs.

Lenders have their requirements for debt-to-income ratio: https://rentalmindset.com/rental-property-loans-first-time-real-estate-investor-know/. The good news is the rental income helps offset the additional debt. I’ll still have quite a bit of wiggle room. I am allowed to take on over $1k a month in new debt payments at my current income – but any additional debt for rentals will also increase the income. So not an issue with lenders right now!

Good point on the emergency fund requirements. I need to do a whole article about it. I have mine in a high yield Capital One 360 savings account with 1% interest.

Your experience with the condo turned rental is definitely a bummer. I would bet the monthly rent is maybe .5% of the value of the property? So if it is worth $200k, it rents for $1k. You can get 1% in lower cost areas, without some of the HOA fees. That helps offset a good amount of maintenance.

It is also unusual it didn’t rebound significantly after the crash. Most areas have. Are SFH in the area also down from 2002-2004? The coast can expect bigger swings, but it should even out: https://rentalmindset.com/lets-visualize-real-estate-cycle/

I have three rental properties. One was $275K when I bought it and it is now worth $230K. We rent it for around $1750. That was kind of a bad decision, but it was bought with the intention of living there not making money.

The other properties are twin condos, worth around 120K. They rent for $1300. So you can see that the math here works out a lot better. (Except for the recent assessments.)

I don’t think the condo aspect changes the appreciation. but just that we got it near the top of the bubble. One of the twin condos was bought in 2011 and it’s up 25K. It’s gone up slow and steady, so that’s ideal. It’s just that you might not be able to count on that.

I’m curious about the rates that you’d be looking at for a cash-out refi. I’m super rate-conscious, perhaps because my goal isn’t cashflowing now, but getting them paid quickly and cashflowing then.

Oh I was way off! I was expecting all 3 to be like the first one.

The $120k for $1.3k rent sounds pretty good! With properties like that, there just isn’t as far for them to fall. With the slow and steady rise, the crash will be much more tepid as well. Replacement cost (which is harder to understand for attached condos) with people needing a place to live is a big reason. Own for one complete cycle, ~18 years, and I bet you look back and think those 2 properties did pretty well!

My new rate is 5%, with is better than my 5.5% mortgage I got in 2011.

As 20 yr veteran real estate investor, I self manage a large portfolio of single family homes. I’d sell the condos for sure, I have many night mare stories of the associations and assessments. If you don’t put cash flow first you will regret it when economy changes and rent are lowered, you will get crushed, but if you have cash flow you have room to lower rents.

Borrowed money is not income, it’s debt. Why would income tax even be considered?? (you say tax free, meaning income tax right??)

It’s actually a pretty common question.

Yes, I mean income tax, social security tax, whatever tax!

Brian, this is definitely a golden option for real estate property owners. We can leverage existing equity into more investments. However, just remember to set aside enough for taxes if you do decide to sell the property at some point. (I know you won’t since you’d just 1031 it). I wonder how you’re going to track all of this when you have 100s of units? 🙂

Ya the taxes later on get a little complex. The appreciation and depreciation benefits are taxed at the capital gains rate (call it 20%) at the time of sale. Rather than setting aside a chunk of money, I am just aware that if I sell the property soon, almost all the proceeds (sale price minus loan balance) will be passed on to the government. Bummer.

A quick calculation is appreciation of $35k, depreciation claimed $2k a year x 6 years = $47k at 20% = $9.4k tax bill. I would certainly clear more than that from the sale minus the loan balance, but might owe $10k on $20k. So wouldn’t have to set money aside, but don’t count your chickens without subtracting the government’s chickens!

You know I’m not going to do that, just keep trading into more and bigger properties. There are certainly people with 100+ SFHs, but I don’t think I’ll be one of them. I imagine I’ll trade up into multi-unit buildings at some point through 1031 exchange.

You can even trade into commercial real estate when you get tired of tenants (for example owning a Chilli’s building with a 15 year lease). Maybe you want to retire and stop keeping track of everything. Cash flow is what you want in retirement anyways, so no need to even sell then!

I have to admit that I don’t know nearly as much about rental properties as I should. This is a great overview on cash refis and it totally makes sense. I can definitely see how collecting rental properties would become an incredibly fun game. Thanks for sharing!!!

There is definitely a lot to know. But it is also possible to keep it simple and let others do most the work. I don’t know much other than the long-term strategy!

As a renter paying $5/sf per month to rent a room in an overcrowded zoo (11 people in a small 3BR with one level and a crawl space), I’m thinking, OMG, I paid off my landlord’s mortgage and have nothing to show for it. And no, I don’t see buying as feasible as I have low income and my ratios are not mortgage-worthy. How can I align my money with my values if I don’t even control my living space? (

Thanks for reading!

We all start somewhere, so do what you can, make daily progress. It is easy to think you can never get there, but taking a tiny action every day will have huge impact over years. This probably means being thrifty and saving as much as you can for now.

Great post. I am most likely going to re-fi one of my properties near the end of the year to use the proceeds as a downpayment on another property. In fact, if rates are good enough , why not re-fi 2 properties ! For some reason , I feel that rates will stay low throughout the year, but that is just a hunch.

Glad to hear you enjoyed it John!

Ya I think if you can do it, pull as much of that equity out and put it to work. Of course it still needs to make sense from a cashflow perspective though.