It is mind blowing how any given second you can know the price of a share of stock.

Actually, that understates it – milliseconds. The price changes fractions of a penny every millisecond.

High frequency traders jostle for the best position in line. Each mile of fiber-optic cable adds a .001 millisecond delay, so they want to be as close as possible to the action.

The cables aren’t always a straight shot, sometimes they wind around 15 miles to travel just 1 mile as the crow flies. Which actually affects real estate prices – firms are willing to pay millions more for the optimal locations.

Prices move much slower with real estate. Transactions take time and effort, which gives an advantage to small time investors like myself, otherwise Wall Street firms would dominate the market.

Six Month Check In

Twice a year I run the numbers on my rental portfolio, which consists of just two properties right now. Lest you think I’m some sophisticated professional investor, let me point out I spent more time on this analysis and write up than I have managing my portfolio the last several months combined!

I feel every six months is the right interval for this analysis. I have a multi-decade outlook, so don’t need to constantly know how I’m doing. Sometimes too frequently monitoring can take your eye off the long-term goal.

But it is important to keep an eye on things in order to adjust if necessary. So how are things going?

Checking the Estimated Prices

My method isn’t exactly scientific, but it’s just an estimate anyway – a house is worth what someone will pay for it, comparables only go so far.

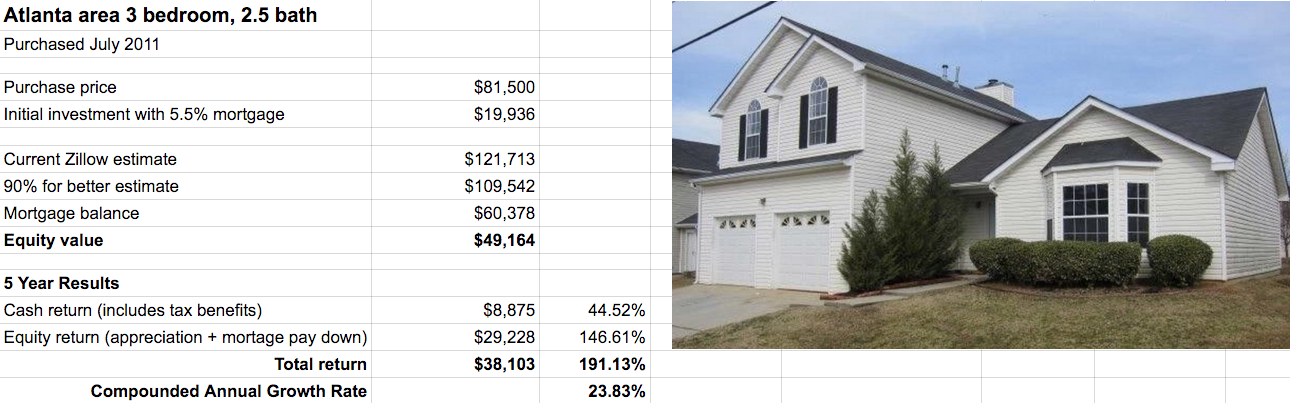

I look up the Zillow price estimate and adjust down if I feel it is necessary. For my Atlanta property the last couple years I have used 90% of the Zillow price and will continue to do so.

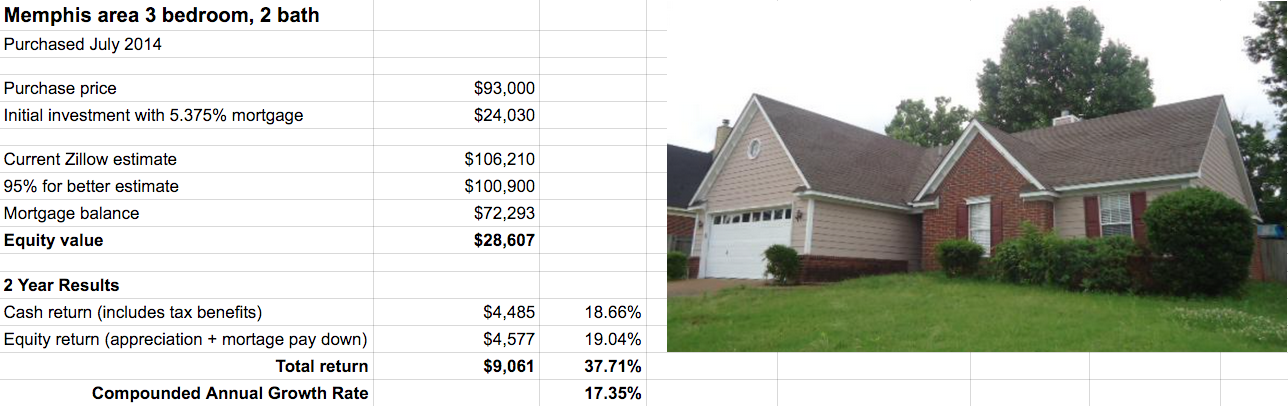

The Memphis property shot up $7k on Zillow in the last 6 months, which is awesome, but probably not too accurate. So this is the first time I will adjust the estimate, taking 95% of it as my value.

In the future, I might average the estimates across multiple sites: Zillow, Trulia, Redfin, etc. At first glance, the estimates are all of the map, so perhaps the average will be more accurate than my current method.

The Numbers

First the Atlanta property, which I have owned 5 years now:

The Memphis property I have only owned 2 years:

And the portfolio overall:

Things Are Going Well!

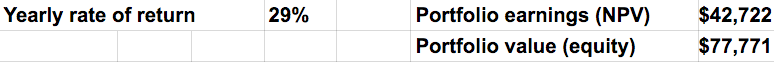

The strong appreciation greatly increased the overall earnings my the portfolio. In 2016 dollars, I have made $43k through rental properties. Just in the last 6 months, my net worth has increased $10k with no effort from me!

The yearly rate of return stayed at 29%, which is a relief because I didn’t want to have to change it everywhere I have it posted on Rental Mindset, Twitter, and Facebook.

This is also better than expected. I would think the yearly rate of return would decline a little between purchases, with the snowball effect of the entire portfolio boosting it back up. In other words, when I double down later this year to refinance the equity of property 1 to purchase another rental, that equity will be put to work. Right now there is a lot of lazy equity in property 1.

Next I’ll provide a recap of the property management over the last 6 months. Is there anything specific you would like to hear?

Download the full spreadsheet and link to the online version