Have you ever heard of the space time continuum? It’s a very hard to imagine way of viewing the universe used by physicists like Einstein. The idea is that in addition to the 3 dimensions of space that we are all familiar with, there is a 4th dimension of time.

Most physicists believe time can only be traveled forwards though. You can’t go back in time like you can move forward in space, then head back to where you were.

Believe it or not, this thinking just might be relevant to investing.

Money-Time-Risk-Return Investment Continuum

Let’s create our own continuum for investments that includes money, time, risk, and return.

Mo Money Mo Problems

Having more money is a good thing (I like money). But it can become a burden at some point – good thing most of us will never have to worry deal with it!

If you are investing $1, what kind of options do you have to invest and what are the returns? Pretty much just putting it in the bank with a lousy interest rate. If you are investing $1k you have different options with greater returns. $100k even more options with greater returns. $1M even better. Then at some point, say at $1B, it gets worse there are few places you can put all that money to work. Of course, you could get a financial advisor to help you make better investments. But, sometimes, even these brokers and financial professionals can make errors in investment recommendations, which can cause you huge financial losses. Fortunately, you can approach a securities lawyer from the likes of The Law Offices of Robert Wayne Pearce to seek the deserved compensation in the event that you face any financial losses made by the financial professionals.

Time is Money

You could put $1B to work just like the investor with $1M, just do it a thousand times. That takes a lot of time and effort.

The average investor can usually put in more time to find a better return. This might mean researching and finding a way to invest in small private companies or doing your own real estate deals. However, there also automated trading apps in markets like cryptocurrency, such as these Bitcoin Up Erfahrungen, for example. This will save you time as you don’t have to do the investing yourself. On a similar note, more and more people tend to see cryptocurrencies as a good investment. These days, people choose to buy cryptocurrencies, like Bitcoin, Ethereum, and even Dogecoin, with the hope that their value can rise in the future, leading to them being able to cash them out later (visit https://www.coin.cloud/blog/how-to-cash-out-dogecoin for information on how to sell cryptocurrencies.)

High Risk, High Reward

Riskier investments should have a greater expected return, otherwise why would anyone take on that risk?

Lending money to a stable company like Walmart might return 3% and a “who knows if it will survive” company like Yelp might return 11% (with a small chance you get zero, so expected return of something a little lower). This is generally true across all assets: stocks, bonds, real estate, peer to peer lending, etc.

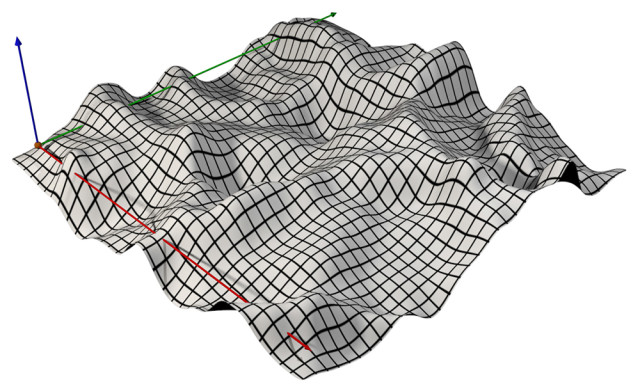

Let’s Graph It!

For a given investment, what is the money, time, risk, and expected return? If you were to graph all possible investments in 4 dimensions, you would be able to visualize the best return for money, time, and risk.

Too bad that’s hard and this is just a thought exercise. If you are thinking in terms of all these dimensions, what is the best investment for you?

Finding Your Advantage

I bet you don’t have a hundred million dollars to invest, where you can push people around and name your terms.

I bet you aren’t an expert at understanding risk, able to notice the flaws in the models of Wall Street.

But you do have time. If we had the 4-dimensional graph, I would imagine there is a sizable bump in expected return by devoting 1 hour a week to your investments.

If you could take your investments from a 8% expected return to 20%, would that be worth an hour a week to you? This is why I chose rental property investing.

Revisiting Space-Time and “Time is Money”

Remember when I said at the beginning that within the space-time continuum, time only travels forwards? You can’t go back in time.

People generally accept the statement that time is money. Time can be easily turned into money, but the opposite isn’t really true. It is much harder to turn money into time. Just look at the richest people in the world – they are running around more stressed out than the rest of us, not sitting on a beach!

With rental property investing there are always more responsibilities you can take on for a greater return. Landlord work, handyman work, increased effort sourcing deals, more aggressive negotiations to only purchase at extreme discounts.

For extra effort might push your return from 20% to 25% with another 1 hour a week per property. Unfortunately it doesn’t scale that well at 5+ properties. Since it is hard to turn money into time, I jump at the chance to pay for someone else to handle those responsibilities.

That’s why I chose turnkey rental properties. I get the benefits of much higher returns through rental property investing, but still fairly low effort.

Managing Risk

Some people have bad experiences with turnkey rental property investing and will be happy to share their nightmare story with you. It is an industry with hundreds of small operations fixing up and selling houses to investors – and many suck.

I could navigate this on my own, but there is certainly a little risk involved. Instead I think it is smart to go through a reputable national marketer like Norada or Jason Hartman. They both have a decade long reputation to maintain and much more experience vetting turnkey providers than me.

The purchase price might be ever so slightly higher than I could find on my own, but I view this as a trade-off between the money and risk dimensions.

Is Rental Property Investing the Perfect Money-Time-Risk-Return for You?

Everyone is different and will come to their own conclusions. For example, maybe spending an hour a week to go from 8% return to 20% return isn’t worth it in your mind. Or maybe you aren’t comfortable with the risk of being directly in charge of your own investments.

For me, rental property investing represents the sweet spot of the theoretical money-time-risk-return continuum. What do you think?

Photo: Etahos

Graph: Jon Waterschoot