It can be frustrating when people just don’t get it.

Like when someone says they don’t like chocolate. Somehow logic just isn’t going to convince them how awesome it really is.

It’s sad because they will never understand and there is nothing you can do to share that joy with them.

A similar thing happens with leverage in rental property investing.

The Common Man’s Access to Leverage

Banks have all kinds of crazy access to loans. When they invest in something they only have to put up 6% of the price in actual money and borrow the rest.

Try walking into your local Scottrade office and doing that. “I’d like to buy 100 shares of Google. I know the price is $736, but I’ll give you $44 and finance the rest at 1% interest.”

Ya right.

Is it a rigged game? In some ways. But you know where the common man has access to leverage? Real estate investing.

20% down, 100% of the upside

The standard mortgage on a rental property right now is 20% down at a 4.5% interest rate. In fact, if you happen to ask around the jumbo mortgage wholesale lenders circle, they might agree to these statistics.

You get to own an asset by paying only one fifth of the price. Where else are you going to be able to do that?

Even better, it’s not like they require the rest of the money within a year or two. You pay the same amount every month for 30 years!

Since you own the rental, you get all of the upside. The bank doesn’t benefit if the house appreciates, you do.

Appreciation with Leverage

By now you know there are 5 different components that make up the overall return on a rental property.

Most people make the mistake of only focusing on one component and forget about the others. Right now we are just going to consider appreciation, but keep in mind this is just one aspect. Don’t forget the others.

The rentals I purchase are in somewhat boring midwest and southern United States cities. Most years they will appreciate at the rate of inflation – this isn’t a speculative beachfront Miami condo I’m hoping to run up 15% per year (as long as there is a greater fool to purchase it from me).

If the property appreciates 3% and inflation is 3%, did I actually make any money? This is where the leverage comes in.

Let’s Run Some Numbers

Over 15 years, what happens?

If you paid all cash, you won’t make anything on the appreciation in real dollar terms. The house goes up 3% per year, but is exactly canceled out by inflation. Your dollars are worth less. After 15 years at 3% inflation, $1 in year 0 has the same purchasing power as $1.56 in year 15.

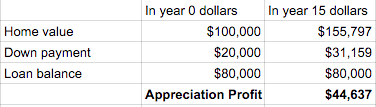

If you use leverage? Let’s look at a hypothetical house where you put down 20% for a $100k property.

To keep it simple, we will just look at appreciation and assume you don’t pay down the mortgage at all over those 15 years. So in year 15 your mortgage balance is still $80k. This number will never go up, so this is the worst case scenario.

See What’s Going on Here?

The investment just keeps up with inflation, but since you used leverage, you made $44,637!

Had you paid cash, the appreciation is exactly zero.

This is powerful stuff people. You took 1 of the 5 components of rental property return from $0 to $44,637, just by taking advantage of leverage.

With Great Power Comes Great Responsibility

That’s a Spider-Man quote, but it is true – leverage can provide huge returns even when the house appreciates at the same rate of inflation.

Don’t take this to mean you should buy a Miami condo which “projects” for even more appreciation. Instead look for the most boring, predictable, steady growth markets – you’ll still get a great return without needing to resort to gambling.

How Much is Too Much?

Leverage is a powerful tool that most people are brainwashed into thinking is bad. You now know better – this isn’t credit card debt, it’s strategic leverage.

The lending limits right now are 1:5 ratio for your first 4 investment properties (20% down). For properties 5-10 it is a 1:4 ratio (25% down). Remember banks are gambling at a 1:16 ratio backed by the FDIC and our tax dollars!

But is there a point where even with boring and predictable rentals, you can have too much leverage? Sure.

If you have 10 conservative cash-flowing properties at a 1:3 ratio, I would argue that is not over-leveraged, even if you have a one million dollar loan balance.

The leverage ratio and loan balance is less important to me. What matters more is how predictable the markets are (not gambling on appreciation, which comes with huge crashes) and if there is enough cash flow to provide a comfortable cushion if things don’t go as well as planned.

What are you comfortable with?