Wowza, that is a big number!

My favorite thing about doing these updates? I put up with a few minor annoyances for 6 months, then find out my reward. And it is massive.

Isn’t saving and investing about delayed gratification anyway? Whenever you hear someone dismiss real estate investing offhand, ask them how much money they’d have to earn to put up with the slight annoyances.

A Quick Look Back

I am the proud owner of 3 properties I have never seen that are located thousands of miles away.

Here is how it went down:

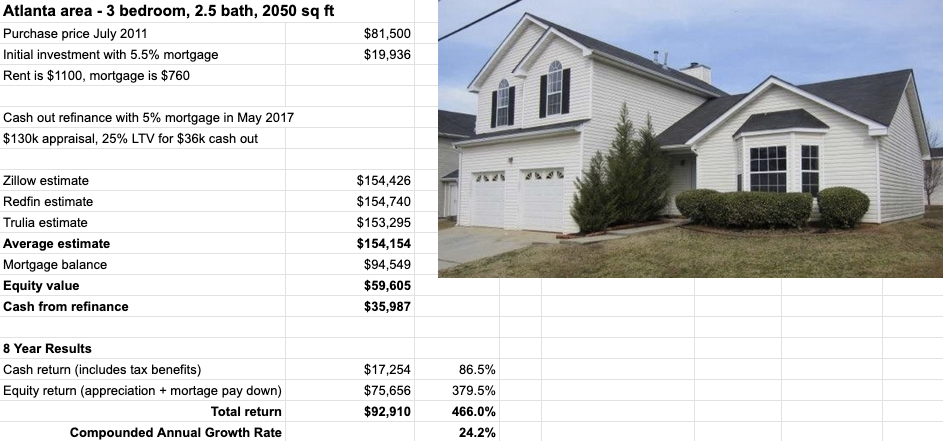

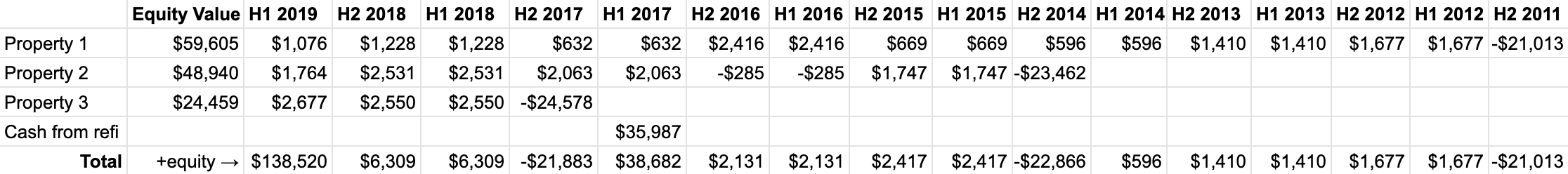

- July 2011 – Bought Atlanta area property for $20k investment

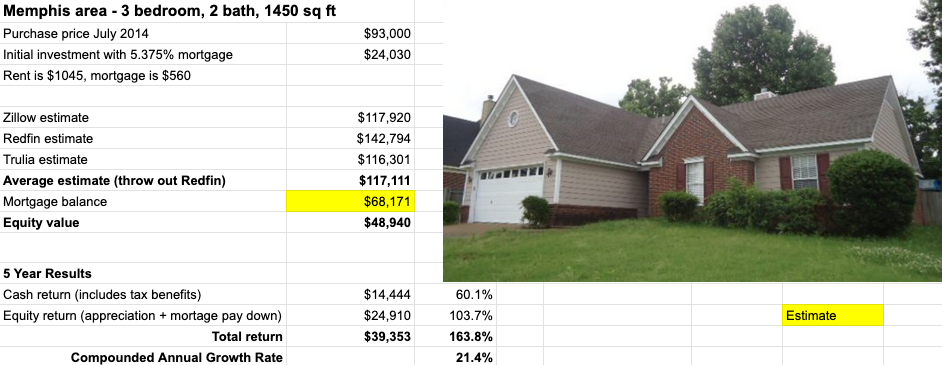

- July 2014 – Bought Memphis area property for $24k investment

- May 2017 – Cash out refinance on Atlanta property to pocket $36k (why and details)

- September 2017 – Bought Memphis area property for $26k investment (search and details)

I think of my portfolio as a snowball gaining 30% more mass each year – yes, I am getting a 30% a year return. My role is to keep it moving with as little as work as possible. I’m pretty hands-off.

Added together, my property managers now collect $3245 in rent each month. My mortgage payments total $1918. With ~10% to the property manager, I’m clearing $1000 a month in cash flow if all goes well!

Let’s look at each individual property, then do a bit of analysis.

Rental #1 Numbers – Atlanta

The OG. Hard to believe it was 8 years ago I purchased my first rental property, way back when I was 25 years old. What is harder to believe – that I was so young or that it is still the same tenant all this time?

There were a couple of repairs so far in 2019. First the insurance company drove by and told me I needed to fix the loose shingles and siding. I had come across a company that offers a high quality roof repair in Gainesville, but obviously, I had to find a service that was a little closer. That was a couple hundred bucks.

Then the water heater needed to be replaced. To be honest, I’m surprised that the heating system didn’t need inspecting at the same time, as the tenants had hinted at some problems with it. But I can always look at something like this page from a laguna niguel plumber and heater experts if anything goes wrong in the near future, as I’ve heard through the grapevine that they’re meant to be pretty efficient. For now though, I just had the water heater to worry about. By Googling the brand they wanted to install, I was able to pretty easily negotiate $200 off the price. But it still was around $1k total with another plumbing issue they fixed. Ouch. Luckily, I found a few Brisbane local plumbers and they were able to sort the issue quickly and efficiently. It was much less stressful than it could’ve been!

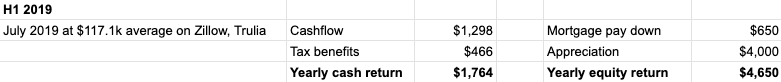

That hurt the cashflow, which already was compressed after my refinance in 2017 (and below market rent). But still a positive number for the first half of 2019. And once again the appreciation was massive – up another $9.4k in only 6 months!

Rental #2 Numbers – Memphis

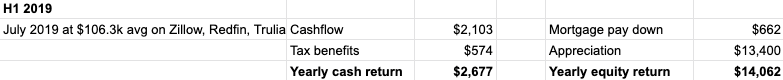

This one is going well. There were a couple minor repairs, but that is fine since the tenant is entering her 3rd year. I’d rather keep the same person than go through the expensive turnover process.

Out of my 3 properties, this one is the most balanced in terms of return from cash flow and appreciation. In 3 fewer years, it has nearly as much cash return as the Atlanta property!

The Atlanta property has 3x the equity return, however this property still has a very nice 21.4% compounded annual growth rate. So even if you don’t luck into appreciation or wonderful market timing, you can still make a killing on boring old properties in boring old cities.

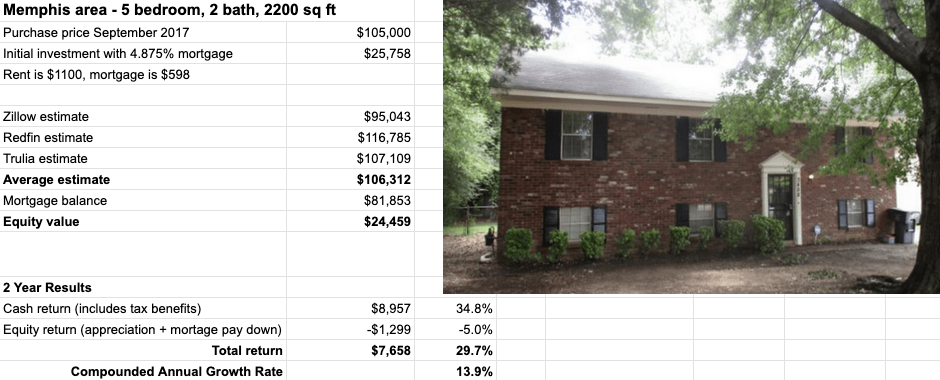

Rental #3 Numbers – Memphis

Still the original tenant for 1.75 years, which means the cash flow is going very well.

But what really helped the numbers are Zillow and Trulia adjustments. They seemed way low just 6 months ago, now they are finally above the purchase price.

The result is a positive return on investment for the first time for this property. A 14% compounded annual growth rate isn’t exactly exciting, but I expect that number to keep rising as we get further from the closing costs.

I think that might be pretty typical when purchasing a rehabbed property. The first couple years it appears to be a meh investment, but looking back 8 or 10 years looks incredible.

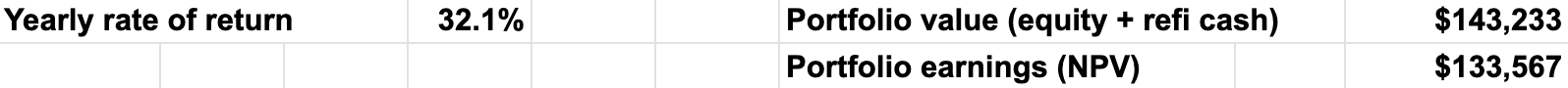

Overall Portfolio Numbers

32.1% yearly rate of return! In just the last 6 months the portfolio earnings (net present value) jumped up $34,295!

Here is the complete breakdown:

What About Risk Adjusted Returns?

I don’t love doing this review because I think it paints the wrong picture. It is easy to dismiss these results as lucky timing or risky.

And there is some validity there – without great timing these numbers wouldn’t look nearly as good. I expect somewhere between a 20-25% yearly rate of return through a whole up and down market cycle.

But the point I want to drive home is that these rentals are not risky. Holding any property for multiple decades reduces a lot of the risk, when the returns are largely just inflation. This is a play on leverage paid by someone else (the tenant). But to make that leverage low-risk, the asset needs to have tangible value (not greater fool value). Each of these rentals is below the cost of construction in areas with a jobs.

These returns are incredible because the risk is so low. Speculating in Miami, Brooklyn, or SF would have had much greater returns over this period, but with a completely different risk profile. Don’t group these cheap rentals in a city like Memphis in the same “risky real estate” category.

You could even argue these properties have more tangible value than the stock market everyone loves, making it is less risky.

But I want to hear from you – how do you evaluate the risk of rental properties compared to the stock market?

I am about 40% real estate and 60% stock market at this point. I like to be diversified between the two.

It’s easier to hold stocks in a Roth IRA and 401ks, so that’s a natural fit for that side. On the real estate side we’re in the last 8 years of a 15 year fixed mortgage, so each month our tenants are paying off large portions of principal.

There’s been a lot of people in the personal finance community who have been against owning rental properties lately. I find it strange and I’m glad you are still around posting updates.

That’s great. Yet another way to make money on rentals, what I called “mortgage pay down” in my calculations. With a 15 year mortgage that is already much bigger, and as you know the amount of the payment that goes to principle increases drastically (e.g. the last payment is almost 100% principle).

It is easy to hate on something when one assumes irrational exuberance without investigating. Or to put down when jealous. Actually a huge number of bloggers who have actually been able to “retire early” have build a lot of their wealth through rental properties. It really reduces the years necessary.

A lot of what I’ve seen from FIRE bloggers on Twitter are people who are actually renters who say stuff like, “Refrigerator broke, glad I don’t have to pay for that.” I’m also seeing some home owners who are getting big bills for repairs and saying, “Looks like we bought a lemon. Home ownership is terrible.”

I’m paraphrasing and these incidents do happen, but it is very specific to that person. It’s difficult for people to see the average case, because few things seem to be very average.

I know that real estate investing is going to be one of the things that I want to teach my kids as a life skill.

Congratulations! Patience is the key to seeing your equity build up over the years.

Are you looking for your 4th property? And how is that going?

I’m still trying to be patient! Actually I’m waiting a couple years to decide about purchasing a primary home in California. Turns out those are extremely expensive. So I want to keep my options open and not get caught spread too thin. Hopefully I’ll get back to adding more rentals before too long though…