The screams slash through the air like a papercut. You rip your eyes from your iPhone and quickly assess the situation.

A cable car is barreling down a San Francisco hill with no brakes. “This is going to end poorly” you think to yourself.

The intersection where you are standing is clear, but the next block is crowded with pedestrians. Some will be able to get out of the way, you estimate five will be crushed. There might even be a car or two in the runaway cable car’s way and the owner might not have a reliable repair shop to contact (similar to the ones who do auto repair in Lakewood) or even insurance per se!

And that’s when you notice it – a lever that turns the track. If you pull it, the cable car will make a right turn at the intersection, before reaching the crowd.

The good news is this is route has fewer people in the way. The bad – one person will surely die – an elderly man is directly on the track and his many years have taken a toll on his reflexes.

You must act now – do you pull the lever?

Duh, no brainer. Obvi. Kill him!

Right?

You save five from likely death, and just doom one to certain death! Simple math: 1 But would that make you a murderer?

TWIST

The lever is gone. In it’s place is a 300 pound man.

If you use your judo skills to fling him under the wheels of the cable car at the intersection, it will come to a stop and not hurtle into the crowd.

Do you do it? Does that change your thoughts on if it is murder?

Fake Situation, Real Takeaways

I love thought experiments (this one is the classic Trolley Problem).

They are unadulterated with the complexities and realities of our world. They exist just in your imagination, but often have profound takeaways for real life.

Did the twist above change how you feel about the situation? Did it change your behavior?

If you are creative enough, you can always find a twist where two logical and ethical people will diverge.

How about in reverse though? What if you and I disagree on something – how can I convince you my side is correct?

What if I invent a thought experiment that boils the complexities of our argument down to the most important components, without the complexities of real world optics? Fake situation, but hopefully you will have real takeaways.

The World of Rubidium Batteries

Imagine a parallel universe where solar is the only allowed source of power. There are giant solar power plants that provide cheap energy, but not necessarily when you need it. That said, it’s pretty easy to find a solar battery supplier so I guess it’s not too much of an issue.

If it is a cloudy day, you don’t get much energy from the power company. If it is night, you get zero which is one of the downsides to solar power.

You can’t just go somewhere to purchase energy at these times, you have to store it yourself. You can check out websites such as Rooftop Solar to look at the proper and safe way to store these.

In this world, there are only one realistic way to store energy – rubidium battery packs. And it will remain this way for all of time.

Governments and large corporations own a very small portion of the rubidium battery packs and it will remain this way. The battery packs are owned by regular people.

Half of the population own their own battery pack, which they share with their family. The rest rent a battery pack.

The Economics of the Battery Packs

The supply of rubidium is fairly fixed. Rubidium is difficult to mine – with labor and manufacturing costs, new battery packs trickle onto the market (and when the economy is going poorly, zero new packs are created at all). Luckily there is a huge pile of rubidium already mined and produced into battery packs. Just enough to meet the initial demand.

It costs $100k to buy a rubidium battery pack.

Who has that kind of money laying around? To encourage ownership, the government provides artificially low guaranteed loans, allowing you to put just 20% down for a 30 year loan at 5% interest.

They rent for $1k a month. After the loan payment, servicing the battery regularly, paying insurance, and other expenses that crop up – the owner pockets $100 a month.

Running the numbers – if you put $20k down, you can expect a 6% cash return per year. But wait there’s more…

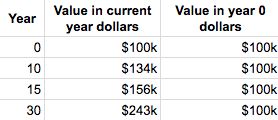

The Value of the Packs Over Time

There is a little math involved, but it is important to understand. Don’t gloss over this section!

Since the supply of the battery packs is tied so closely to the demand, the price tracks fairly closely to inflation at 3%.

So next year the packs will cost $103k. It doesn’t always work out exactly – there are ups and downs with the economy, but over several decades, it will average 3% a year.

The result is neutral for the battery pack owners who paid for it upfront – compared to inflation the battery packs neither gain nor lose value over time.

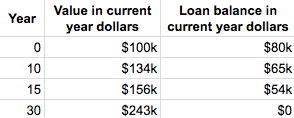

But those who finance get some nice value upside.

The loan balance is decreasing at the same time.

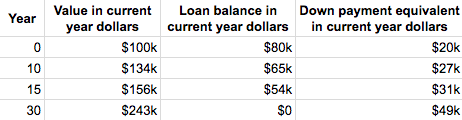

How did the loan holder do compared to inflation? We have to convert his initial down payment to the value of the dollar in the current year.

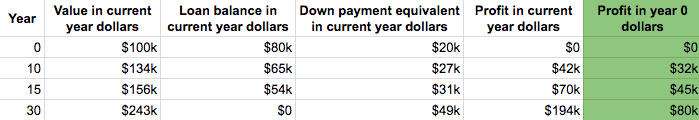

- $20k 10 years from now is $27k. So in +10 year dollars you have a pack worth $134k, put a down payment equivalent to $27k, and owe a loan balance of $65k. You made $42k. I like converting back to the original year dollars to understand it better, so you made $31k

- 15 years from now: $156k (current value) – $31k (down payment equivalent) – $54k (loan balance) = $71k. In original dollars: $45k

- 30 years from now: $243k (current value) – $49k (down payment equivalent) – $0 (loan balance) = $194k. In original dollars: $80k

That is serious money just through the combination of the renter slowly paying down the loan for you, the value keeping track with inflation, and the loan balance not tracking with inflation.

Financing is the Way to Go

If you pay upfront for the rubidium battery pack, you make a 6% return per year. Pretty solid.

If you finance it at 20% down, your return varies slightly upon how long you keep the battery pack, but it is roughly $3k extra per year. On a down payment of $20k, this is a 15% return + the 6% cash return = 21%!

Which would you prefer, a 6% or 21% yearly return?

How many battery packs would you buy? Share / Tweet this

The Common Complaints

I have to have renters for all the battery packs, what a pain. Is a small inconvenience worth it for a 21% yearly return?

Only 6% of the return is in cash, the other 15% is just a paper asset value I don’t get to spend. Sounds like this would be a benefit for you because saving isn’t your natural tendency.

The estimate of the expenses of owning a battery pack are off, insurance costs more.Ok so drop the numbers a little, still way better than any other investment options.

What if the renter abuses the battery, it costs more to repair, and is a huge nightmare? Or what if they stop paying? Or what if

Don’t these complaints seem petty?

Back to the Real World

I set up this rubidium battery scenario to hit upon the basic math of investing in rental properties. Everyone has their own preconceived notions about real estate investing – hopefully this thought experiment helped you cut through some of the malarkey.

I want you to understand the benefits of investing in rental properties before you decide it is too hard.

One more nugget of math to show you it is worth struggling through any road blocks to figure it out.

Say you plan to retire in 30 years. $20k invested in the stock market with an 8% return per year, gives you $200k.

Put that $20k in rental properties at a 21% yearly return, you have $6 million. There is definitely work reinvesting the profits, which you can’t do continuously, so let’s adjust. If you lower the estimate down to $2 million, it is literally still 10x better than the alternative.

How many speed bumps would you fight over for a ten time better result? Share / Tweet this

Would you let petty complaints hold you back? How many batteries would you buy?

Warning: Heavy sarcasm ahead in this comment. I love real estate and I think this is a great article with some solid points. Now to play a lot of devil’s advocate…

Can I use my ninja skills to throw a rubidium battery pack under the trolley? 😉

I don’t think you go from looking at you cell phone to being a “murderer” in the span of a few seconds, especially if you are saving 5 people. But hey, I’m new to the trolley problem, this is the first I heard of it.

In “Solar World” it seems like rubidium is a (valuable) commodity. All battery packs seem to do the job and seem to do it equally. In a comparison of rubidium battery packs to real estate, I’d suggest that real estate is abundant and not rare (like rubidium battery packs). How many New York Cities could you fit in Montana? I think the difference here is location… which is like saying that some rubidium packs afford people special benefits (I think).

My wife bought a rubidium battery pack in 2002 (before I met her). I bought one in 2004. Now 13-15 years later, the value of each of them is worth about 75% of what we paid. Some rubidium battery packs we bought are performing more in line with your math.

If you are offering me 21% annual gains, I’m all over it. I’ll happily take 14% annual gains for you to make the rubidium battery packs pay off.

“Can I use my ninja skills to throw a rubidium battery pack under the trolley? ” Ha!

Usually thought experiments are delivered verbally, with plenty of time to let things sink in and visualize. Plus the subject can ask clarifying questions. Then if they say the ‘no brainer’ answer right away, the moderator can add more complex twists. I’m not sure if an article is the best format, but it is worth a try.

The comparison to real estate definitely has it’s complexities. Land is abundant. New houses though take a lot of work and have significant costs that are largely tied to inflation as well (labor, materials, transportation, etc) and quality is well regulated. So it’s not like those new properties will be drastically cheaper than the ones I am comparing them to ($100k property in a place like Indy or Memphis).

New York is what people think when they hear real estate. Which clouds their judgement on these more affordable rentals. That is a whole ‘nother supply and demand problem that is way harder to predict and has much larger swings. Let’s consider that the master class and stay far away!