$101k to be exact. Badda bing, badda boom.

My three rental properties are currently worth $101,091. Even more impressive, since I started on this passive cashflow real estate journey six and a half years ago, I have earned $73,368.

But we’ll get into the numbers in just a second, I feel a silly interlude coming…

Worth My Weight in Gold

I’m feeling pretty solid about the growth of this small portfolio, but what will it take to be worth my weight in gold?

Luckily the fine folks of the internet built a calculator for just that. I know nothing about gold prices and troy ounce conversions, so let’s take their word for it.

190 pounds equals $3.7 million in gold. I have a long way to go.

My portfolio is currently worth 5.2 pounds of gold though. So maybe it would be easier to go on an extreme diet?

Now Back to the Regularly Scheduled Show

2017 was a good year. I made some big changes to the portfolio, setting up for even more success down the line. Let me quickly get you caught up to speed on my major actions:

- July 2011 – Bought Atlanta area property for $20k investment

- July 2014 – Bought Memphis area property for $24k investment

- May 2017 – Cash out refinance on Atlanta property to pocket $36k (why and details)

- September 2017 – Bought Memphis area property for $26k investment (search and details)

I think of my portfolio as a snowball gaining 30% more mass each year – yes, I am getting a 30% a year return. My role is to keep it moving with as little as work as possible. I’m pretty hands-off.

My first rental property appreciated in price over the years while the tenant paid down the mortgage. It had a lot of equity. Equity is wonderful, but it is like a bank account that doesn’t pay any interest. So in 2017 I put that money to work.

Added together, my property managers now collect $3120 in rent each month. My mortgage payments total $1918. If about ~10% goes to the property manager, I’m clearing $900 a month in cash flow if all goes well!

Let’s drill down and look at each individual property.

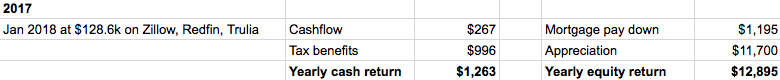

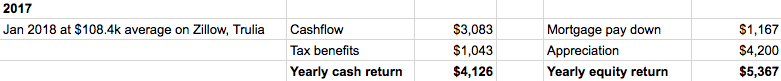

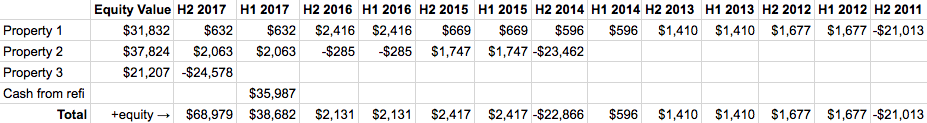

Rental #1 Numbers – Atlanta

The estimated value is conservative. It appraised for $130k back in May when I did the refinance. I would be justified assuming that was the price, but I used $128.6k which is the average of Zillow, Redfin, and Trulia. Not that they are more accurate than an actual appraisal, I just don’t feel the need to pick a larger number to inflate my sense of self worth.

Notice the cash flow here sucks. A measly $267 in 2017? I spent more than that on avocado an toast.

The same tenant has been in the property all six and a half years I have owned it! That does amazing things for cash flow overall, because I don’t have to turn over the property with a million little repairs and touch ups, nor have the 1-2 months of lost rent.

Yet this tenant is often behind on rent. They didn’t pay for December by the end of 2017, so are behind again. Hopefully a tax refund gets them caught up again.

The other big thing affecting the cash flow on this property was the refinance. Mortgage payments went up from $616 to $760. But it also allowed me to purchase a third rental, which offsets the lost cash flow on this property. And gets more equity snowballs rolling!

Beyond the cash flow, this property has crushed it over six and a half years:

I initially invested $20k and it has made me $61k. Wowzers bowzers!

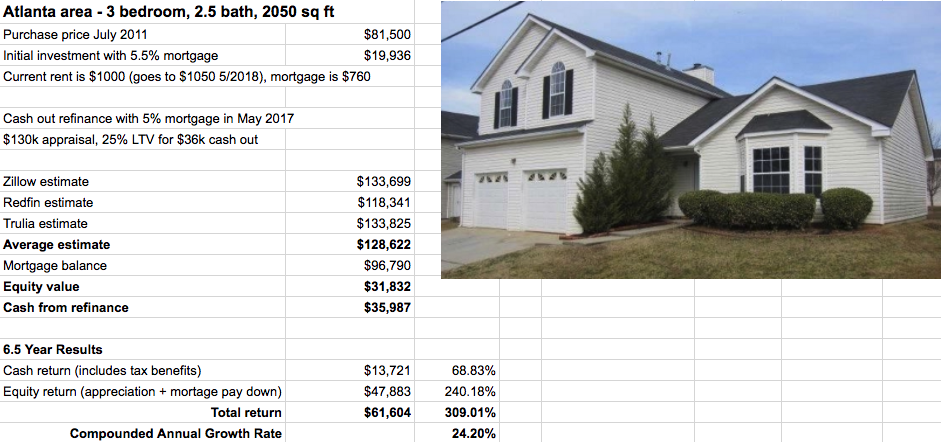

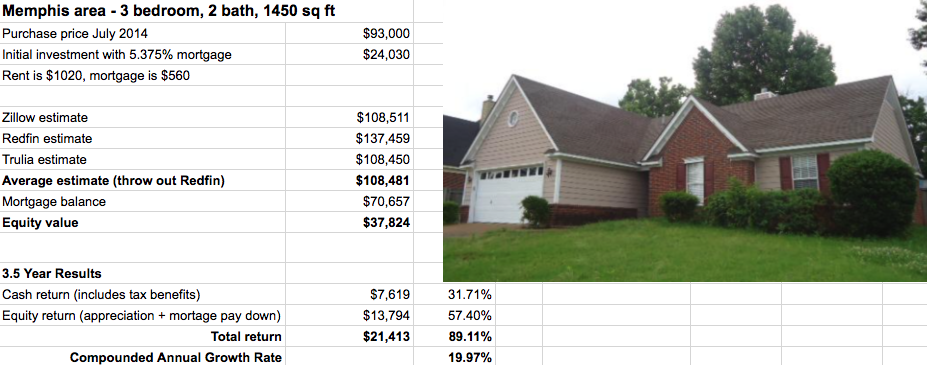

Rental #2 Numbers – Memphis

This one had a much better year on the cashflow. $3083 plus another $1043 in tax benefits.

This isn’t exactly the time to discuss the tax benefits, but basically thousands of dollars are tax free thanks to a fake expense called depreciation. If it is tax free, the equivalent income in taxed dollars is even greater.

The appreciation here is more modest as Memphis isn’t going to have as large of swings as Atlanta. It has been appreciating at 4.5% a year though over the three and a half years.

However this has been a large national upswing. If things go south nationally, Memphis will hold fairly steady compared to other markets, but not hit 4.5% those years. Let’s call it an expected 3% a year for appreciation.

Considering it is leveraged five to one, you still make a killing with modest appreciation at the rate of inflation. That’s a 15% a year return right there!

Doing great, a 20% compounded annual growth rate on this sucker!

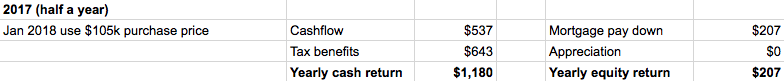

Rental #3 Numbers – Memphis

This one is just a few months in. There were only 2 mortgage payments and 3 months of rent, so the cash flow as positive even though there were some additional tenant placement expenses.

When we look at the overall picture, it doesn’t start out pretty. You have to pay closing costs and fund your escrow for future taxes and insurance payments.

My overall return is negative $3.3k. I have to overcome the expense of closing costs before it becomes positive.

That’s ok, it is another snowball rolling and gaining mass!

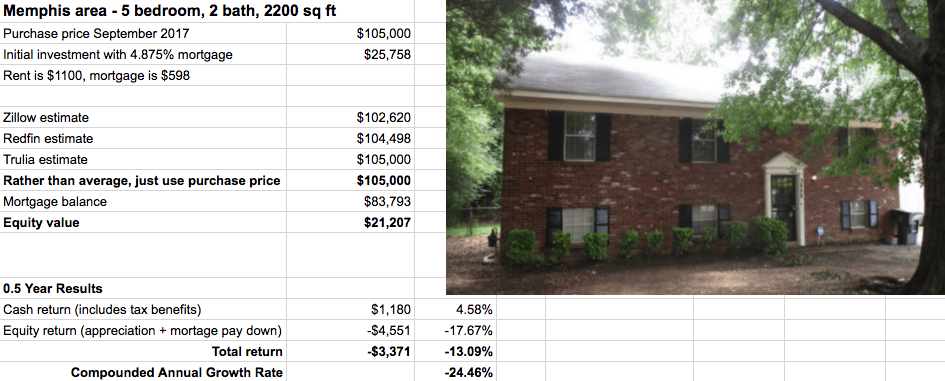

Overall Portfolio Numbers

Those numbers don’t tell the whole story though. It is more accurate to do a cash flow analysis.

When you have an asset that spits off cash in addition to going up in value, it matters when you get that cash. $1k received six years ago is more valuable than $1k received today. I can invest it and make extra money over that time. That’s what a cash flow analysis accounts for.

If you know when you received the money and how much value you put on receiving the money earlier (I used 2% every half year), you can calculate the total earnings of the portfolio.

![]()

29.9% a year return! That is pretty darn solid.

And I still have $10.2k left over from the refinance that isn’t invested yet, that I hope to put to work in 2018.

Long time readers will note that the portfolio return a year ago was 30.7%. It dipped despite a good year in the market due to the refi and adding the third property.

Ya gots to spend money to make money – the dip was largely due to closing costs on the loans. But it allowed me to put lazy money (equity) to work, which will set up for greater returns in the future. If you are apprehensive about closing costs, you can find the relevant information on websites such as https://houstonrealestateobserver.com/ as well as others, so you can see what is ahead of you and how you can better navigate your way through with your money.

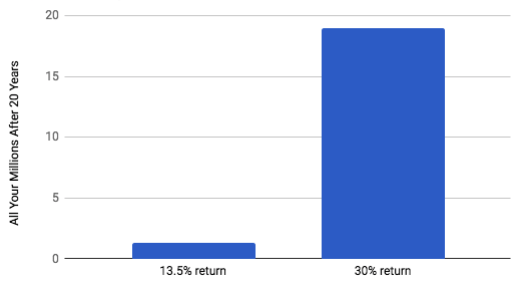

“Ya But I’ve Been Crushing it In the Stock Market with Less Work”

You wouldn’t be wrong to think that initially. After all, the S&P 500 went from $1292 in July 2011 to $2673 by January 2018. It more than doubled!

Actually sit down and run the numbers – what is the compounded growth rate?

> … 11.8%, pretty darn good. “That doesn’t account for dividends though” says the astute reader.

Ok I used this calculator for the Russell 3000 (a more broad index fund) and it spit out a 13.53% yearly return.

Jerry is not impressed. That killer run the stock market has been on doesn’t hold a candle to the returns of these cashflow rental properties.

We are talking 13.5% to 30%. That is massive. And not just “oh it’s 16.5% different” – it is exponentially different.

Over 20 years $100k invested:

Sorry for crushing your positive feelings about this great stock market run. You lose.

Get Going!

The sooner you get your own snowball rolling the better.

I’m not going to pretend my approach will scale well to millions of dollars invested, but I know if you are generating your first $100k (and probably million), you can’t beat these low-cost cashflow rental properties when everything is considered (including risk and time invested).

It all comes back to the cheap leverage available and the margin of safety provided by the tenant’s rent well above expenses.

What are you waiting for? Think you can do it?

If you want to see the spreadsheet with all the calculations and numbers, click here.

Great work Brian! Hopefully, the next 6 years are even more fruitful than the last.

I certainly hope so. You know the saying “the first million is the hardest”. I bet $100k to $200k is a whole lot quicker than $0 to $100k.

It’s exciting, isn’t it? That is exactly what making your money work for you means. Onward and upward!

The money is starting to noticeably work. The first several years it is hardly noticeable, but before too long it gets to an impressive number like $100k!

I really like your comparison to last year’s stock market returns. We’ve invested in rental properties for well over a decade now and the cash flow and appreciation has been excellent for us too! But a lot of people say “Oh, what a headache, I’m just going to buy index funds.” So it’s nice to see there’s still a benefit to real estate investing!

Thanks. I should do the stock market comparisons more often. I see that as an excuse for not getting into REI as you said, and also from real estate investors who get lazy or forget how much better the returns are.

Nice job laying out the details in an easy to follow fashion. I’d agree that your real estate snowball is just beginning… exciting stuff!

Are you still targeting Memphis?

Yes, Memphis still works great at this point. Hard to say “this is the absolute best market right now”, but since I already have a couple there, my next one will probably be there as well. Good cash flow, lots of stable jobs!

Do you recommend the turnkey provider you used in Memphis recently? I’m looking at that market now and would be interested in your recommendation if you had a quality experience.

I work through Jason Hartman’s referral network, they do some quality control on the different vendors, then I worked directly with the turnkey provider throughout the process. I’ve worked with 2 providers in Memphis and I’d be happy to share my experience over email – both went well. Use the contact form.

This reminds me of an article that I wrote back in April of 2007 (interesting timing in hindsight!) titled Stocks vs. Real Estate.

It was very simplistic because it was just as we started becoming landlords (not by choice) and I didn’t consider the properties to be cash flow positive. I was only measuring the equity growth with leverage.

I found that in the short-term (a few years) real estate wins due to leverage. However, over the long term, stocks appreciate more than real estate (at the time I presumed stocks average 10% and real estate 4% or 5%).

Here’s a quote that I think you’d like:

“However, if one were to lock in the gains of real estate at year 8 (around $125K), the person could use the gains to buy three more $200K homes getting more an more leverage. ”

Sound familiar ;-)?

Absolutely!

Basically when you have a ton of equity at years 25-30, it is such dead weight (0% return) that the returns dip below the theoretical 10% return of the stock market.

Or put another way – the stocks in your calculation have compounding. The return each year generates a larger return the next year. The real estate returns (appreciation) go into a “savings account” that pays 0% interest (equity). But as you said, there are ways to access that money!

Great example why I think it is crazy in most cases to pay down the mortgage as fast as possible!

I completely get it mathematically. Unfortunately for us, 2 of the 3 of our properties were bought at the wrong time for the reasons of living in them. Our lives changed, but selling when they were so far underwater wasn’t an option. So we don’t have ideal properties, except for the last one, bought in 2013.

Building any equity took far longer than typical… ten years just to get positive. If you are planning it and planning it well, I can see how it would be a world of difference.

So even though the math now works, the problem is that we are left to do the work on all three properties because they aren’t cashflowing. Attempting to add more might get me served with divorce papers – j/k ;-). Now once we get them all paid off and they are cashflowing really well, we might take that annual income (expected to be 40K) and buy one more each year knowing that we can outsource the management of all of them. I really don’t know, but at this point, it’s important for me to show “a light at the end of the tunnel” with these. While mathematically we could refinance them at a lower rate and make them cash flow positive now, the idea of kicking that 40K annual income stream into the future isn’t going to win any debates in our house ;-).

So there’s a math side, a “life happens” side (market crash), and a personal side. I love to read about the math side that you present in articles like this.

Makes sense! It is very easy to spout off numbers, but I hope people don’t mistake it for advise. Everyone’s personal situation is so different, as well as their priorities. It’s wonderful you know what you want and are executing on the plan.