“Oh, I’m a visual learner” said the high school student assigned a stack of books to read over the summer. “I guess I’ll just have to watch the movies instead…”

Do you ever get the feeling that people decide they aren’t good at something out of laziness? Have you really tried or is it just an excuse?

I also suspect there is an enabling parent behind the scenes. Socially awkward? We must homeschool or his self-esteem will suffer! Bad handwriting? Let’s tell the principle it is stupid to learn to write in cursive, so we can get out of it.

Let’s not let this rant go too far though, there is some science to support these “visual” learners. And somehow this article is eventually going to be about real estate cycles…

Different Learning Styles

There are 7 different learning styles that are widely accepted, including verbal and visual.

Everyone can learn from every different style, although some might be more effective for you. If you learn the same thing in multiple styles, you can learn it even better.

For example, you might start by reading a book. Is there a graphic that sums it up? Is there also a song with the same content? Can you make a social role-playing game out of it?

If so, the concept will sink in deeper.

Linear and Cyclical Markets

We all have heard that real estate has cycles. The prices will run up for 7 to 10 years and then come crashing back down. Rinse and repeat.

Rental property investors understand that markets behave differently. This is the kind of information you would only be aware of if you had consulted a real estate investing coach though. Some markets (A.K.A. cities) are really effected by this, others just a little bit – real estate investors often label these cyclical and linear markets.

Examples of cyclical markets are dallas real estate, Phoenix, and Las Vegas. Examples of linear markets are Indianapolis, Memphis, and Kansas City.

Even though we know these markets behave differently, it is hard to get a feel for just how different they are. All too often, people who live in places like California, New York, or Washington D.C. assume real estate has huge swings everywhere.

If only there were another way to get this point across…

A Visual for Real Estate Cycles

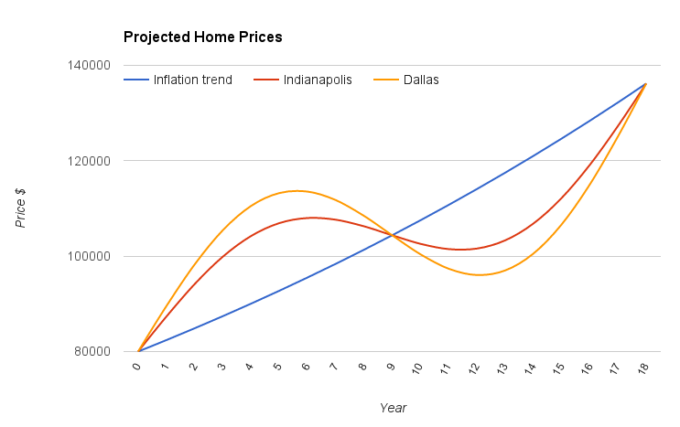

Here is a theoretical view of the cyclical and linear real estate markets:

A house that costs $80k in year 0 (completely neutral point in the cycle) will appreciate differently in each market. In Dallas it will peak at $114k, but in Indianapolis only $108k.

This extra appreciation leads to bigger crashes too.

In Dallas the peak-to-trough is a swing of $18k. So if you bought at the top of the cycle, you would see your home value take a big dip. In Indianapolis the peak-to-trough is $7k. Prices do decline, but they are much more manageable.

This means that if you want to sell or buy houses in Indianapolis, you’re less likely to see a drastic decrease in prices like you would in Dallas. There are still high and lows in the market but that’s just the nature of real estate – you would probably feel more comfortable investing money into a more manageable market like Indianapolis.

Also notice how many years it takes to get from the top of the market, through the crash, and back to the original price. In Indianapolis this is about 7 years, in Dallas roughly 10 years.

The Most Important Thing to Notice

Two things contribute to appreciation – inflation and the market cycle.

Over the course of an entire market cycle, roughly 18 years, both markets keep up with the inflation trend. So take away all the market swings, and they are equal!

This is why I’m not as concerned about timing the market. For my long time horizon, say 15 or 20 years, the cycle doesn’t really matter.

If you are investing with the goal to sell in 3 to 5 years, you better get the timing right. Unfortunately that is extremely hard to do – many people claim they can, but in fact they just got lucky.

It is for these reasons that most real estate agents nowadays use circle prospecting and other approaches to generate leads. In real estate, you never know when someone in a specific area might be considering putting their home up for sale, and therefore it is vital to use real estate technology tools and geographic farming techniques to stay one step ahead of your competition.

Theoretical Look, Real Take Aways

This visual gives you an idea of how the cyclical and linear markets behave differently. But this is a theory – how does the actual data match up? This is something we’ll dig into next time.

Does this visual help show the differences between the market types? What specifically would you like to see in the actual data?

—

Here is the complete spreadsheet of calculations.

I’m right there with you. I’m invested for the long term, so my timing isn’t as critical as long as I have cash flow. I’m curious though, what is the 18 year full cycle period based on? Is that a historical average over some time period nationally?

“As long as I have cash flow” – definitely true.

The 18 years is a number that is thrown around as the best estimate. It does vary though. There is a brief overview of the theory here: http://www.dce.harvard.edu/professional/blog/how-use-real-estate-trends-predict-next-housing-bubble

To quote from the article: “Perhaps the most stunning aspect of the real estate cycle is not its inevitability but rather its regularity. Economist Homer Hoyt, through a detailed study of the Chicago and broader US real estate markets, found that the real estate cycle has run its course according to a steady 18-year rhythm since 1800.

With just two exceptions (World War II and the mid-cycle peak created by the Federal Reserve’s doubling of interest rates in 1979), the cycle has maintained its remarkable regularity even in the decades after Hoyt’s observation.”

Im lucky enough to have a few houses here in Austin which is a cyclical market however at the end of the day, I feel more comfortable investing in the linear markets.

Deep down inside though I hope one day those linear market cities turn into highly desirable areas and really drive up the prices of real estate. After I own a ton of real estate there of course though. 🙂

I think Texas overall is in a good place to not just hand back all those gains in the next downturn – so many people have moved there!

I’m not as convinced we’ll see a ton of people rushing to move to a place like Indy or Kansas City as we have seen with Texas. As long as there is steady growth, home prices will keep gradually going up. But I guess we will see! There are a lot of millennials forming families later with student debt and huge expenses on the coasts. Maybe that will drive more of them to a higher quality of life elsewhere (and not just everyone to Texas)…

The article does not mention the change in taxes. Caps on deductions will have an impact as well as the ceiling on mortgage size qualification. I suppose that has no impact.

One can read a lot of different things into the graph. Also, are all the years normalized to the 2000 dollar? The run up to 2005 was MUCH steeper than the one from 2005 to 2018 with the “start point” low in 2011 being at 140. A ratio of 185 to 120 versus current of 195 to 145.

House prices are often driven by interest and taxes. Raise either or both, and the homes that are affordable get smaller.