If you own any real estate, just about everything has skyrocketed. Just when I thought the rally might peter out, it accelerated even faster!

Or maybe the same could be said about any asset. Stocks. Used cars. Lumber. You name it.

There is a word for it. Inflation. But don’t forget the rule: whenever you want to say inflation, you have to add the word transient before it. Easy to forget.

The going has been good for rental properties, yet I don’t claim to take credit. I didn’t do an exhaustive search to find the perfect rental property. I don’t manage the day to day tenant process. This is achievable for anyone with little work, then you can sit back and actually have remarkably low risk over a couple of decades. So without claiming to be a genius, here are some numbers you can aspire to hit yourself!

A Quick Look Back

I am the proud owner of 3 properties I have never seen that are located thousands of miles away.

Here is how it went down:

- July 2011 – Bought Atlanta area property for $20k investment

- July 2014 – Bought Memphis area property for $24k investment

- May 2017 – Cash out refinance on Atlanta property to pocket $36k (why and details)

- September 2017 – Bought Memphis area property for $26k investment (search and details)

I think of my portfolio as a snowball gaining 30% more mass each year – yes, I am getting a 30% a year return. My role is to keep it moving with as little as work as possible. I’m pretty hands-off.

Added together, my property managers now collect $3280 in rent each month. My mortgage payments total $1976. With ~10% to the property manager, I’m clearing $1000 a month in cash flow if all goes well!

Let’s look at each individual property, then do a bit of analysis.

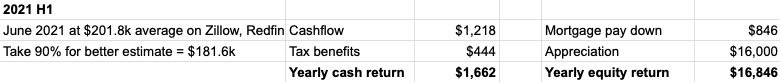

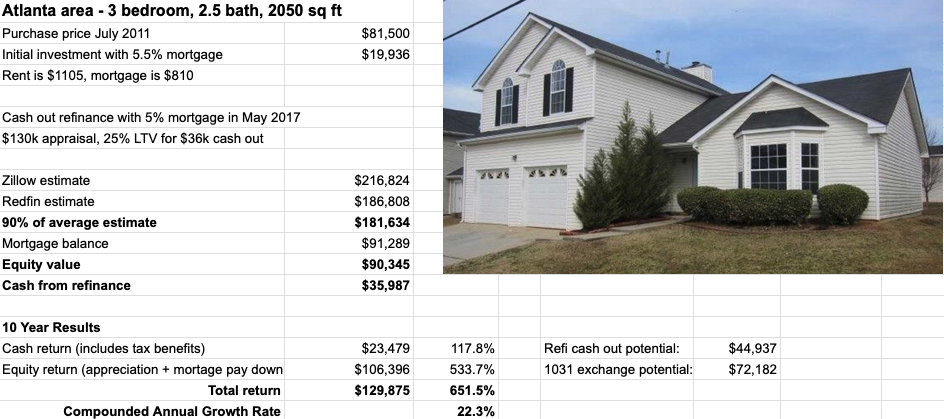

Rental #1 Numbers – Atlanta

The tenant just hit 1 decade in the property! That is pretty bonkers!

I don’t think there is much to report on this one, I can’t recall any calls or emails in the last 6 months. It jumped up $16.8k though for a nice equity cushion. Looks like the mortgage debt is around 50% of the equity value now, despite being at 25% just 4 years ago when I did the cash out refi.

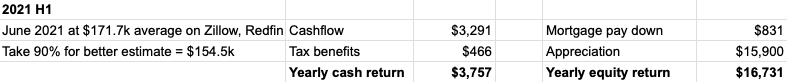

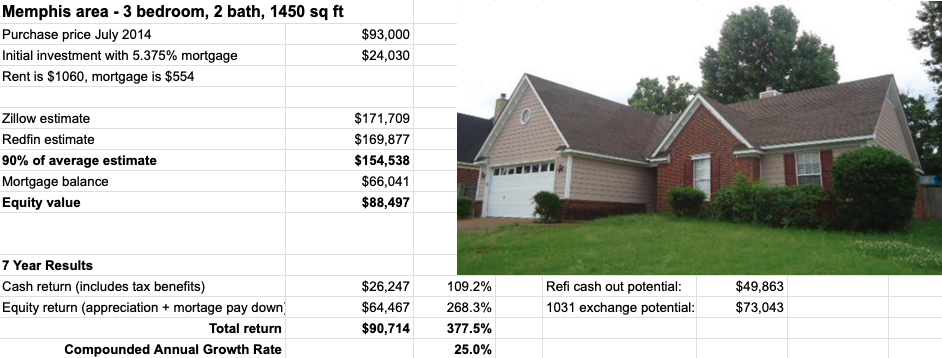

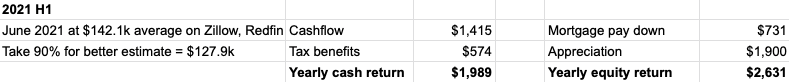

Rental #2 Numbers – Memphis

This one is going pretty solid. I did need to replace the garage door though – not the opener, the door itself. The property manager also signed the current tenant up for 2 more years at below market rent. While I like reducing tenant turnover, I wish they were more aggressive on the rate considering things are now shooting up. Ultimately it is on me though since I’ve been meaning to switch property managers for years and have just been too lazy.

The cashflow is still incredible on this property and it also was at $15.9k of appreciation is 6 months. This is the one I’m in the middle of doing a cash out refinance on, which we’ll get to in just a bit.

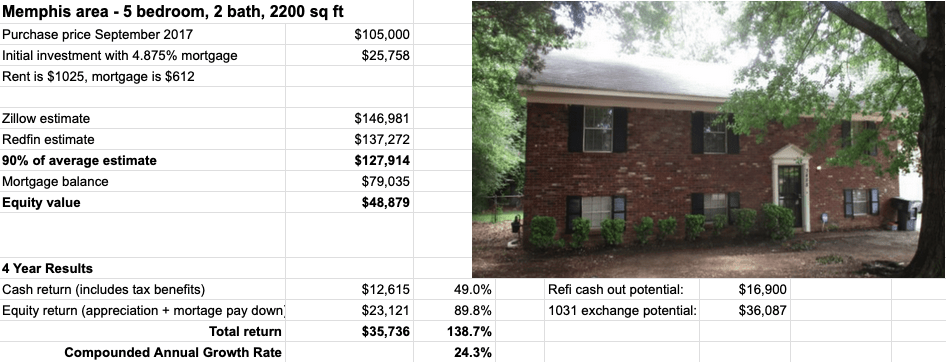

Rental #3 Numbers – Memphis

I’m pleasantly surprised this one is going well too. It had the tenant turnover one year ago now and is running smoothly. You may notice the appreciation is only $1.9k, but that is because I switched from doing 95% of the Zillow-Redfin average to 90% like I’m doing on the other properties.

Overall Portfolio Numbers

![]()

The rate of return just keeps increasing! 33.2%, up from 32.5% six months ago.

Plus just hit a quarter million dollars on the overall earnings! And yes, I’m using a discount rate of 2% per half year, so it is legit. Of course the vast majority of it is unrealized equity gains though. Here is how it breaks down:

Next Steps: Cash Out Refi and Buy Another Rental Property

Back in 2017 I did a cash out refi on #1 and used the cash as the downpayment on #3. Keep that snowball gather mass! Well this year I’m doing a cash out refi on #2 to purchase #4.

I’m just a few days away from the refi closing. It has been somewhat smooth, the appraisal came in low at $135k, we provided better comps and they updated it to $142k. Still not great (Zillow is $170k so I was hoping for at least $150k), but my take away is you need to make sure there are enough sales within 1 mile in the last several months if it is a rapidly appreciating market (the last summer comps hurt more than helped).

I’ll receive around $35k to put towards a new property. Still looking in Memphis 38128 area, although I won’t limit myself to just the turnkey Jason Hartman network at this time. I’ll go more into why and the search process in a later post, but it is just because inventory is so low right now.

Why Buy at the Top of the Market?

You might be wondering if this is really a good time to add another property. Everything is so expensive right now, the cashflow numbers don’t look as good.

Timing the market is tough. Timing a manipulated market is even tougher. In short, I think regular market swings are now politically untenable. They will do everything in their power to limit any decrease in prices, and all the tools they have are likely to increase inflation. This holds true no matter the party in office.

I don’t know when the crash will come. But it is likely that if you wait, you’ll miss a lot of run up before then. Plus whatever response there is to the next crash will make sure it is brief, followed by inflation that is beneficial for rental property investors.

So therefore now isn’t a bad time to buy. Get started!

I love that you are still doing these updates. I’m also excited to read about the new property. It’ll be interesting to see how it works out.

I’ve been telling people that this is a good time to build up cash and be ready to deploy in the case of a crash. However, the way you are doing it (via a cash-out refinance), I guess it doesn’t matter, since a crash would mean that you’d lose at least some of the equity that you would be using to buy the new property.

You take property analysis to a whole new level. Fascinating. Could you spend a blogpost dedicated to how you run these numbers? (or if you already have, point to where to find that?)

What part of it in particular is surprising? I run the numbers every 6 months, so it isn’t hard to do, but there was a little setup at the start.