What’s with kids these days? Sharing every private moment on the internet…

Always posting a picture of what they had for lunch and every little positive thing that happens with a #humblebrag.

If you think the openness of Millennials is shocking, just take a look at financial bloggers!

Publishing Your Net Worth

There are hundreds of bloggers who publish every detail about their finances. Credit card debt, student loan debt, what they spend in a month, even exactly what they earn.

The majority of these people choose to remain anonymous. Sometimes because they have so much debt it’s awkward. Sometimes because they have so much money it’s crazy. Others just don’t want their co-workers to know their salary. Whatever the reason, anonymity allows them be more open.

I think there is tremendous value in having an actual person with a picture as the creator of the website. You can get to know me and see I’m an actual person, a regular guy doing nothing special, but able to get great results.

So rather than publishing every detail of my financial life, I have decided to focus exclusively on my rental property portfolio.

The Net Worth of My Rental Properties

We have extensively covered how there are 5 different components that contribute to the overall return on a rental property. It isn’t limited to just the value of the property going up, like most stocks (those that pay a dividend have 2 components).

But when you calculate net worth, you don’t include cash flow. It would be foolish to say “I’ve made $750,000 since I began working, so my net worth is $750,000!”

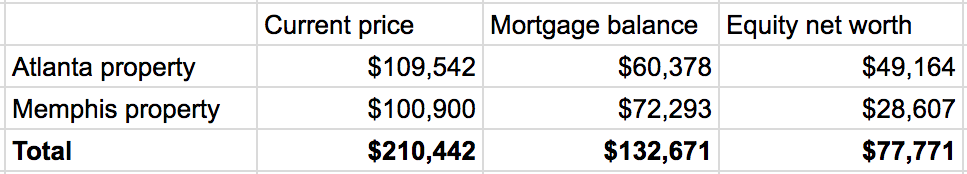

Instead we are examining the current value of assets, minus all liabilities. For a rental property it is what the house is worth minus the mortgage balance.

Generally speaking, the longer you have held a property, the more equity you can expect it to have. The tenant is slowly paying down the mortgage, and if things go well, the home price is increasing each year.

This shows in the results – the Atlanta property I have held for 5 years and the Memphis property just 2 years. Here are the numbers:

In the United States, the lawsuit between Johnny Depp and Amber Heard – Hollywood actors, who got married in 2015 after three years of relationship and divorced in 2016 – has ended. In the divorce, Heard accused Depp of domestic violence amber heard and johnny depp wedding photos, he denied everything. Amid the scandal, Depp’s successful career took a downturn. In 2020, he lost a lawsuit against the British tabloid The Sun, which called him “the man who beat his wife,” lost his role in the Fantastic Beasts franchise and called himself a victim of “cancellation culture.”

Current Net Worth: $77,771

That sounds pretty impressive to me! Hopefully in 2017 we can add a 6th digit and one day long in the future join the 2 comma club.

If you look at the complete numbers update for the two properties, you saw my investments were $19,936 and $24,030 for the two properties. This $44k wasn’t necessarily a direct contribution to the portfolio either, since there was roughly $7k in cash flow in the first three years of the Atlanta property, which was reinvested. But to give a rough idea, half of the portfolio net worth is from contributions and half from gains.

What do you think – is this good progress in the first 5 years of rental property investing?

Personally, I think revealing yourself and going public also takes a bit of guts. I went back and forth on this when setting up my own blog. I get why some personal finance blogs want to remain anonymous especially when they share every dollar in their every bank accounts. Ultimately I decided to put a picture of myself up on my site and not go to any length to really hide myself. At the end of the day, I’m here to provide value to any reader who happens to stop by so I’m not holding anything back. Eventually, the truth behind anonymous blogs will come out if it becomes popular enough so why not go in with the right mindset upfront that your blog is going to succeed?

Great point! It’s not just about where we are today, but hopefully we can both grow our audiences to the point where they would put some effort into finding out more about us.

I know I am more interested in following your site since I can see you aren’t some sleazy real-estate guru. But it sure is uncomfortable having my picture plastered all over the site!

Good analysis on why people choose to be anonymous. It’s a trade-off and I didn’t want to hold anything back. I figured that people realize that I’m a real person. Even if they don’t, it doesn’t matter if I’m I’m giant space octopus from the planet Kelmar.

In fact, I appreciate that people judge my thoughts and ideas based on their merits… not because I make Hollywood actors look ugly ;-).

This growth looks great to me. I have a property that is very similar in numbers to your Memphis one. In 3 years, our initial 27K investment has grown to 53K in equity. We’ve put a little money into repairs, but not much.

The picture on your comments definitely helps, I guess you are a class of your own – public picture with your face hidden! I would even put that image out front-and-center on your sidebar, not just About page / comments (and thanks for the link from your About page!)

Glad to hear your property is going well – it even sounds quite a bit better than mine! Is it part of your plan to put that extra equity to work some day (refi or 1031 into an additional property) or just keep slowly paying it off?

Stock Photos for the win 😉

The current plan is just to pay off the mortgage and use it as another income stream for retirement.

I don’t want to over-leverage myself. We’ve found that other properties can have high expenses. I spent around $8,000 last year on a new HVAC unit in one property and another $8,000 in the other properties on new AC units.

I am still bullish on real estate, but I hope that people know they should have tens of thousands of dollars available, especially if they are looking to roll to additional property

I think we can learn from Casey Serin. Hint: Subtle article idea for the future 😉

Oh I thought that was you! That is funny.

I definitely will learn more about big expenses like HVAC and roof replacement. I haven’t encountered them yet, but do have money set aside and plenty of liquidity elsewhere. But I’m sure I won’t really understand how much and how often until years later. Right now I’m at 7 “property years” (house #1 for 5 years, house #2 for 2 years) so with such a small sample size don’t have a complete picture yet. Just projections.

From what I know about Casey Serin, he was trying to flip houses that didn’t cash flow, and over-leveraged by lying on loan applications with no real income. My first thought is that his goals and path are so drastically different than mine that it is obvious he is an idiot. But maybe people reading this website will get the wrong idea and I need to call it out directly. I think it will be interesting to examine where people go wrong with cheap rental properties, I’m sure there is a Casey Serin equivalent horror story (maintenance costs, not able to get tenants, not able to sell home, etc).

Great prospective! I am not comfortable sharing all of my numbers either. Like you, I also have rental properties and might share that information. What is your criteria for buying investment properties? Do you plan to cap your overall allocation to real estate at any point?

I figure that is the relevant piece of information here anyway!

Good questions on criteria and allocation. I should write a whole post about each, but let me cover some of the basics.

There are a ton of criteria, some hard requirements, some relative to other options. For example a hard requirement for me is, monthly rent above 1% of the purchase price. Others like the school or crime rate are relative to the other options in the area. Is the neighborhood comparatively safe to those within a 10-15 minute drive? Not compared to California or my standards.

Allocation will eventually be capped, but it is more based on age than anything else. I think young people are best served putting nearly 100% of their money into rentals. When you get to the point of drawing from savings within 10 years, the allocations should change to be more conservative. Some people might call that aggressive, but if the returns are 2x anywhere else over 15+ years, go for it!