It is mind blowing how any given second you can know the price of a share of stock.

Actually, that understates it – milliseconds. The price changes fractions of a penny every millisecond.

High frequency traders jostle for the best position in line. Each mile of fiber-optic cable adds a .001 millisecond delay, so they want to be as close as possible to the action.

The cables aren’t always a straight shot, sometimes they wind around 15 miles to travel just 1 mile as the crow flies. Which actually affects real estate prices – firms are willing to pay millions more for the optimal locations.

Prices move much slower with real estate. Transactions take time and effort, which gives an advantage to small time investors like myself, otherwise Wall Street firms would dominate the market.

Six Month Check In

Twice a year I run the numbers on my rental portfolio, which consists of just two properties right now. Lest you think I’m some sophisticated professional investor, let me point out I spent more time on this analysis and write up than I have managing my portfolio the last several months combined!

I feel every six months is the right interval for this analysis. I have a multi-decade outlook, so don’t need to constantly know how I’m doing. Sometimes too frequently monitoring can take your eye off the long-term goal.

But it is important to keep an eye on things in order to adjust if necessary. So how are things going?

Checking the Estimated Prices

My method isn’t exactly scientific, but it’s just an estimate anyway – a house is worth what someone will pay for it, comparables only go so far.

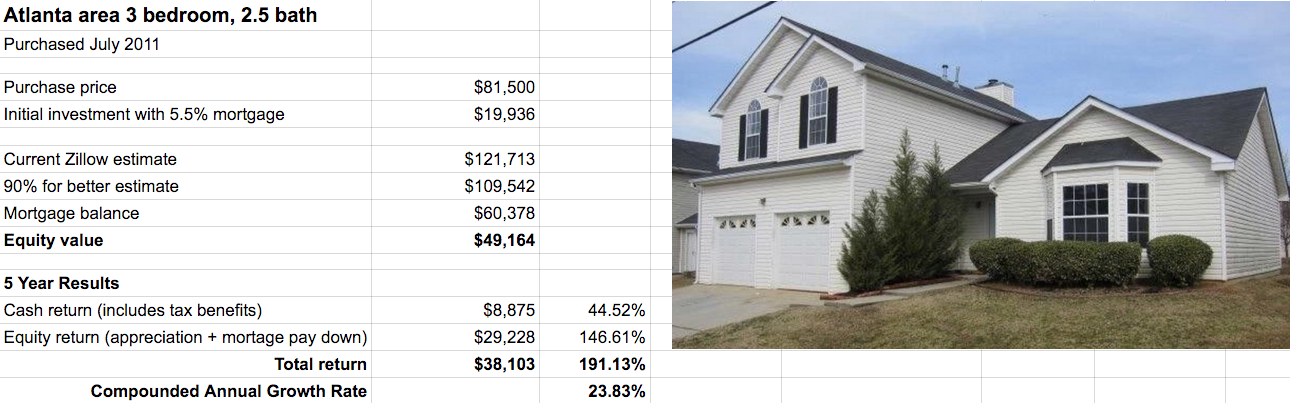

I look up the Zillow price estimate and adjust down if I feel it is necessary. For my Atlanta property the last couple years I have used 90% of the Zillow price and will continue to do so.

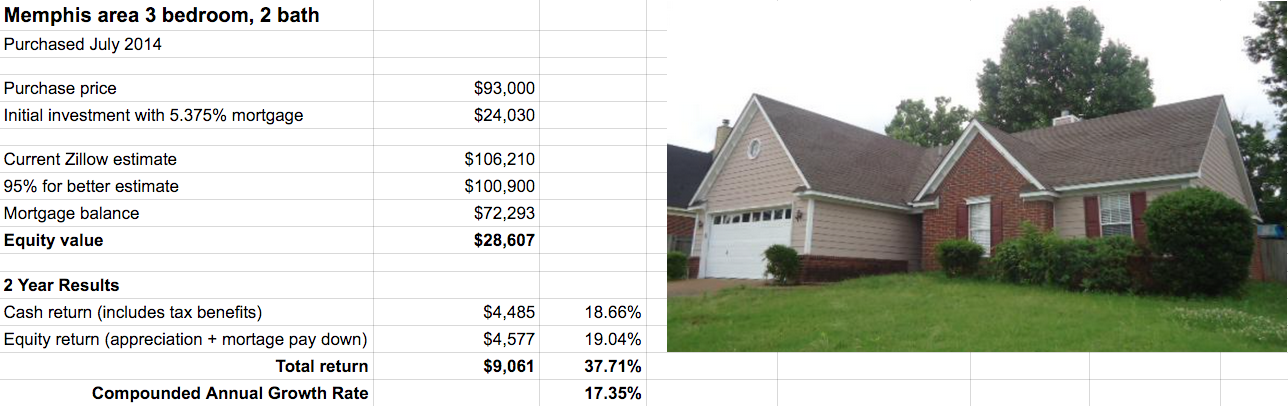

The Memphis property shot up $7k on Zillow in the last 6 months, which is awesome, but probably not too accurate. So this is the first time I will adjust the estimate, taking 95% of it as my value.

In the future, I might average the estimates across multiple sites: Zillow, Trulia, Redfin, etc. At first glance, the estimates are all of the map, so perhaps the average will be more accurate than my current method.

The Numbers

First the Atlanta property, which I have owned 5 years now:

The Memphis property I have only owned 2 years:

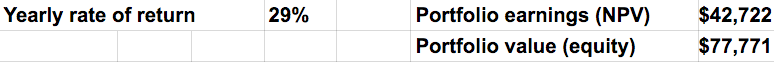

And the portfolio overall:

Things Are Going Well!

The strong appreciation greatly increased the overall earnings my the portfolio. In 2016 dollars, I have made $43k through rental properties. Just in the last 6 months, my net worth has increased $10k with no effort from me!

The yearly rate of return stayed at 29%, which is a relief because I didn’t want to have to change it everywhere I have it posted on Rental Mindset, Twitter, and Facebook.

This is also better than expected. I would think the yearly rate of return would decline a little between purchases, with the snowball effect of the entire portfolio boosting it back up. In other words, when I double down later this year to refinance the equity of property 1 to purchase another rental, that equity will be put to work. Right now there is a lot of lazy equity in property 1.

Next I’ll provide a recap of the property management over the last 6 months. Is there anything specific you would like to hear?

Download the full spreadsheet and link to the online version

Congratulations on the increase in net worth. Some of the real estate blogs I’ve been reading have been getting me excited about real estate. I would like to know the hard / difficult parts you’ve endured in the past 6 months with the property management, if there are any.

Sounds good, I’ll include the difficult parts in the last 6 months – no filter!

Nice post Brian! I think 6 months is just fine for a buy and hold investor to check in on the estimated value of their properties. Some investors do it quarterly. I agree that if you’re just holding it long term, then there’s not really a point to keep checking on the value of your home unless you’re planning to sell or refinance in the near term.

It is nice to see the numbers go up, but twice a year is enough for me.

I know you report your cash flow numbers every month. Do you recommend an analysis on those numbers more frequently?

Checking the value of my property is something I haven’t really been doing at all. I sometimes check out Zillow’s zestimate of my property when I’m curious, but haven’t taken the time to actually track it. Cash flow on my rentals on the other hand, I revisit at least every month.

While I get monthly statements from my PM, I have my own P&L sheets that I update monthly. It’s just a simple excel based spreadsheet that breaks out all income, expenses, debt payments, and bottom line cash flow per property. I like doing this for 3 reasons. First, it’s a check that the PM is doing correct math and disbursing the correct amount to me each month. Second, it’s a good reference come tax time since I organize expenses in my P&L sheet much like the Schedule E tax form (https://www.irs.gov/pub/irs-pdf/f1040se.pdf). Third, I’m sort of a geek and like to know over the year what % certain categories like maintenance is really costing me. A lot of us like to use 10% in our estimates so it’s interesting to know what % or dollar amount such expenses end up.

Honestly, I think for SFRs, checking up on the cash flow monthly is enough. Only when a rental is having an issue (e.g. late paying tenant, vacancy, etc.) do I then check more frequently.

Makes sense. Is refinancing or a 2-for-1 1031 exchange a part of your strategy? It’s a big part of mine to get the snowball effect, and knowing how much equity is in a property will allow me to know when is the right time.

Those are phenomenal results, Brian, and it seems like you’re taking great pains to be conservative with your market value estimates, which makes your numbers that much more impressive. Congrats!

Well sometimes I wonder if my numbers should be even more conservative! If I were going to sell a property, there would be many expenses like repairs, touch-ups, and realtor fees. So my $70k in equity, if I were to sell both properties, wouldn’t net me that much.