Cash flow rental property investors often describe appreciation as “icing on the cake”.

Meaning it is nice to have, but shouldn’t be the main reason you invest.

I am chowing down on that icing and it is SWEET!

Why I View Things Differently

Appreciation isn’t a nice to have, to me it is the main driver of returns.

My goal is slightly different than most investors – I want to build long-term wealth, not live off cash flow as soon as possible.

All cash flow for the next decade or two will be reinvested to achieve the snowball effect of growing the portfolio. All appreciation for the next decade or two will be reinvested as well (for example through a cash out refi).

There are 5 components of return on rental properties – I don’t care where I get the returns as long as they are big. With a multi-decade timeline, leveraged rental properties are the best investment, and I believe the biggest part of those returns will be appreciation.

But I Don’t Chase Appreciation

Cash flow is the margin of safety.

Real estate is known to have huge swings – it is very likely I will have underwater mortgages one day. That is when you owe more on the mortgage than the house is worth.

I won’t panic though, it will only be temporary. Since I’m looking at it from a decades long view, I will wait it out.

How do you wait it out? With cash flow!

For a normal year, I want a 10% cash return. This is the margin of safety for when disaster strikes and I have to replace the plumbing or something major. I will need to bring in professionals to get it sorted out and I want it done right, so whether I’m looking for a septic tank cleaning in Colorado Springs CO service or new pipes being fitted, I want to make sure it is going to be done in the best and most efficient way.

What a contradiction – I invest in cash flow markets with the hope of big appreciation?

Bingo! That is how I manage the inherent risk of leverage. No need to gamble, going for a boring ol’ 25% yearly return is good enough for me.

2016 Actual Results

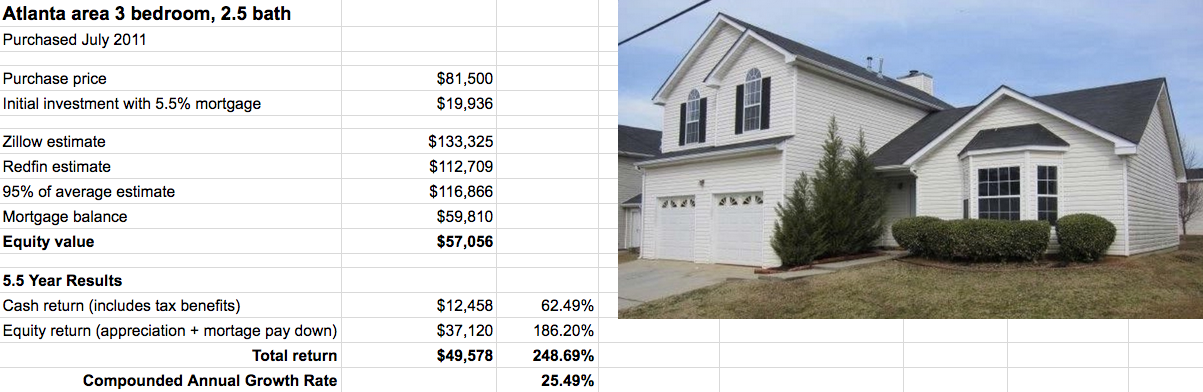

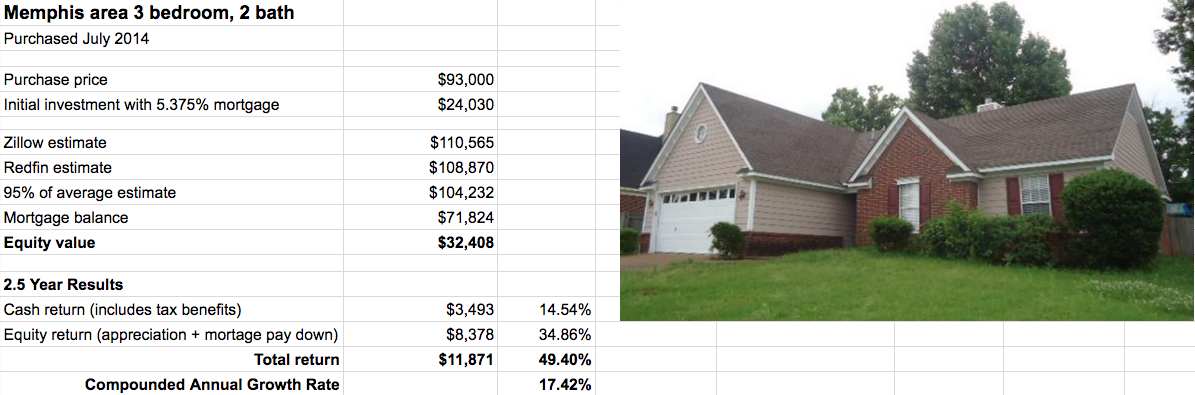

I have two properties. A 3 bed, 2.5 bath in Atlanta purchased 5.5 years ago and a 3 bed, 2 bath in Memphis purchased 2.5 years ago. Out of pocket I invested $44k combined.

For 2016 the returns were:

- $2,222 in cash flow (even with the rough year in Memphis)

- $2,039 in tax benefits

- $2,225 in mortgage pay down (my super-sophisticated term for amortization)

- $18,000 in appreciation!

I haven’t done my taxes yet, but I actually think I might show a loss in 2016. So all that cash flow is tax free, then some might be carried over to 2017. Yet I walked away with $2,222 more in the bank. Aren’t taxes great!

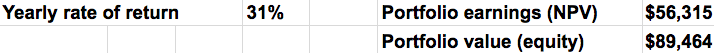

The equity news is even better. A year ago the portfolio value (equity) was $69k. Today it sits at $89k! I know stocks had a great year, but you aren’t going to beat that!

The Details

Here is Atlanta:

And Memphis:

I made a slight change on how I determine the property value. I am now averaging the estimate found on Zillow and Redfin, then taking 95% of that for my estimate. Though I could always find a professional property valuer to get a pinpoint accurate value, for the moment it is not necessary. I’m not planning on selling just yet.

For the overall portfolio:

Nice big numbers aren’t they? Though if you are into things like IRR, NPV, and discount rates, you can get the entire spreadsheet here.

Looking Forward

A 31% yearly rate of return on my portfolio! This is incredible considering my properties are passive investments without getting my hands dirty doing repairs or even collecting rent checks myself.

Although the scoreboard currently shows 31%, I expect that to come down to 25% when we progress through the entire real estate cycle.

One of the things that will help with the overall portfolio return is when my properties start cloning themselves. Right now my Atlanta property is 49% paid off, which is awesome until you consider there is $57k in equity that isn’t earning a return. This year I will access part of that equity to invest in another property. That new property (the clone) will be all upside with no out of pocket expense from me in 2017 (just the original $19k in 2011).

The caveat being – there will be zigs and zags. I’ll keep checking in on the portfolio value every 6 months, but won’t cry if I don’t maintain a 31% yearly return.

How did your rental properties do in 2016? If you don’t have any yet, what is holding your back from getting the snowball rolling?

I averaged Redfin and Zillow for awhile, but I found that Redfin was banana pants crazy in comparison with my expectations and what Zillow said. No (well few) rental properties are the same, so as the saying goes, your mileage may vary.

That said, Zillow estimated all my real estate holdings higher for the first time in years. (Perhaps that is more about New England real estate… I don’t know.)

In any case, the returns on leveraged real estate can impressive as I found out this year.

Ya such simplistic methods will certainly be flawed. But it’s good enough for my purpose.

Actually the only “out of whack” estimate was my Zillow Atlanta estimate. Almost 20% higher than Redfin!

Glad to hear your returns are going well too!

I think that’s key… understanding what is within the range and what is outside of it.

I get chastised for using Zillow sometimes, but it works for my properties.

What works is what works. 😉

In the meantime, I’m going to chow down on renters paying down the principle on my properties. Yum!

Awesome job. I’m looking forward to the state of the blog post you have planned.

Hey Brian, my rental properties appreciated nicely this past year. I’m in it for the long haul, so it’s just fun to look at on paper. I would certainly like to pick up some more but haven’t found any compelling deals lately. Congrats on the appreciation and cash flow!

Glad to hear yours have been doing well too!

I’m hoping to pick up some properties in 2017, so will be digging in to where to find a good deal. I’m a believer that good done now is better than perfect done never – it definitely applies to real estate too!

Congratulations on your outstanding return Brian. Got to love the cash flow of your Memphis and Atlanta properties.

Have you compared how much you would have made had you bought in SF 5.5 and 2.5 years ago? That would be a neat comparison.

What are your main reasons why you don’t buy a primary residence? I’ve really enjoyed the homes I’ve bought here in SF over the past 13 years. It’s been nice to buy, live in it for 2-9 years, then rent it out and repeat.

I responded to your comment on FS regarding being negative RE crowdsourcing btw.

Sam

Thanks for stopping by Sam!

Well the main reason I haven’t even considered a primary residence in SF is lack of funds. We all start somewhere. Someday I’m sure I will own my primary residence (probably in Marin), but consider it more consumption than investing.

I’m sure the last several years in SF have been a much greater return than my investments. Hindsight on a cyclical market though. As I live through more cycles maybe I’ll start to feel more confident in timing things right, but it is a risk that I don’t really feel is necessary.

Got it. Yes, gotta start somewhere. Most folks just wait to start by amassing the nest egg for their primary residence. So, congrats to you for taking some risk earlier and not waiting.

The good times are over in SF until Uber or Airbnb goes public next year or so. Then, it’s probably back to a very, very tight market. In the meantime, I want to allocate capital to the heartland, hence my Heartland of America post.

S

Comparing it to the “default” approach of 401k mutual funds is something I should look at though. I’ll have to do that for an upcoming post.

I enjoyed your Heartland of America article – you said the more negative arguments the better, so I decided to be bit more aggressive than usual with my thoughts …

Pretty awesome appreciation. Were the properties appraised for pretty much the purchase price when you bought it? One good thing about the out-of-state property I bought was a foreclosure and the PM managed the renovation. It appraised for about $10,000 more than I paid. I was hoping to do the BRRR method but will probably have to wait on that. I read your previous post about a cash out refinance…didn’t know it cost that much!

Yes, the properties were appraised at exactly the purchase price.

Well you can use the cash you pull out to pay for the refinance. So it’s not exactly that you have to show up with that much money. I like to think of the equity kind of like a bank account that pays zero interest – that money isn’t earning anything so if you can pull that money out and use it to earn more than the fees / interest payment, go for it!

I do agree with Brian. I’m irked by unrealistic real estate advice that’s overly optimistic. It’s so nice that you keep it real.

I’m glad to hear this! Sometimes I worry that my returns so far (29% per year) will sound too good to be true. Too optimistic.

Rather than saying I expect over 20% a year return, maybe people would find it more believable if I said 12%? How many people are put off by the real estate advice that is too optimistic?