It can be frustrating when people just don’t get it.

Like when someone says they don’t like chocolate. Somehow logic just isn’t going to convince them how awesome it really is.

It’s sad because they will never understand and there is nothing you can do to share that joy with them.

A similar thing happens with leverage in rental property investing.

The Common Man’s Access to Leverage

Banks have all kinds of crazy access to loans. When they invest in something they only have to put up 6% of the price in actual money and borrow the rest.

Try walking into your local Scottrade office and doing that. “I’d like to buy 100 shares of Google. I know the price is $736, but I’ll give you $44 and finance the rest at 1% interest.”

Ya right.

Is it a rigged game? In some ways. But you know where the common man has access to leverage? Real estate investing.

20% down, 100% of the upside

The standard mortgage on a rental property right now is 20% down at a 4.5% interest rate. In fact, if you happen to ask around the jumbo mortgage wholesale lenders circle, they might agree to these statistics.

You get to own an asset by paying only one fifth of the price. Where else are you going to be able to do that?

Even better, it’s not like they require the rest of the money within a year or two. You pay the same amount every month for 30 years!

Since you own the rental, you get all of the upside. The bank doesn’t benefit if the house appreciates, you do.

Appreciation with Leverage

By now you know there are 5 different components that make up the overall return on a rental property.

Most people make the mistake of only focusing on one component and forget about the others. Right now we are just going to consider appreciation, but keep in mind this is just one aspect. Don’t forget the others.

The rentals I purchase are in somewhat boring midwest and southern United States cities. Most years they will appreciate at the rate of inflation – this isn’t a speculative beachfront Miami condo I’m hoping to run up 15% per year (as long as there is a greater fool to purchase it from me).

If the property appreciates 3% and inflation is 3%, did I actually make any money? This is where the leverage comes in.

Let’s Run Some Numbers

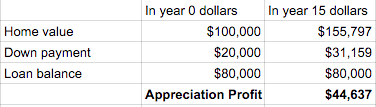

Over 15 years, what happens?

If you paid all cash, you won’t make anything on the appreciation in real dollar terms. The house goes up 3% per year, but is exactly canceled out by inflation. Your dollars are worth less. After 15 years at 3% inflation, $1 in year 0 has the same purchasing power as $1.56 in year 15.

If you use leverage? Let’s look at a hypothetical house where you put down 20% for a $100k property.

To keep it simple, we will just look at appreciation and assume you don’t pay down the mortgage at all over those 15 years. So in year 15 your mortgage balance is still $80k. This number will never go up, so this is the worst case scenario.

See What’s Going on Here?

The investment just keeps up with inflation, but since you used leverage, you made $44,637!

Had you paid cash, the appreciation is exactly zero.

This is powerful stuff people. You took 1 of the 5 components of rental property return from $0 to $44,637, just by taking advantage of leverage.

With Great Power Comes Great Responsibility

That’s a Spider-Man quote, but it is true – leverage can provide huge returns even when the house appreciates at the same rate of inflation.

Don’t take this to mean you should buy a Miami condo which “projects” for even more appreciation. Instead look for the most boring, predictable, steady growth markets – you’ll still get a great return without needing to resort to gambling.

How Much is Too Much?

Leverage is a powerful tool that most people are brainwashed into thinking is bad. You now know better – this isn’t credit card debt, it’s strategic leverage.

The lending limits right now are 1:5 ratio for your first 4 investment properties (20% down). For properties 5-10 it is a 1:4 ratio (25% down). Remember banks are gambling at a 1:16 ratio backed by the FDIC and our tax dollars!

But is there a point where even with boring and predictable rentals, you can have too much leverage? Sure.

If you have 10 conservative cash-flowing properties at a 1:3 ratio, I would argue that is not over-leveraged, even if you have a one million dollar loan balance.

The leverage ratio and loan balance is less important to me. What matters more is how predictable the markets are (not gambling on appreciation, which comes with huge crashes) and if there is enough cash flow to provide a comfortable cushion if things don’t go as well as planned.

What are you comfortable with?

Great article! You did an excellent job of explaining why appreciation at the rate of inflation can still make you a bunch of money in real estate. So few people are able to explain that clearly, and many others just seem to not understand the concept.

Your punchline is perfect, too, that the ratio of leverage isn’t really what matters, but predictability and enough cash flow so that you have a cushion. Some people borrow absolutely every penny of what the bank would let them borrow, and they got all the properties they wanted, but then any one change runs the risk of knocking the whole house of cards down.

I have a family member who mortgaged two of his small mobile home parks and refi’d his house to scrape together a down payment on a larger park. Everything looked like it was going to be fine, but a few months after he bought, the water company’s rate literally tripled. For a SFR, that stinks, but for a mobile home park where the owner pays for water for 100+ households, that can be devastating. That, plus the economic slowdown, plus a couple of other factors demolished his whole dream, and his life savings. After seeing that, I try to be careful to leave a pretty healthy cash flow cushion. You never know when some financial factor might change on you.

Thanks, I’m glad the explanation makes sense! This is possibly the #1 idea I want people to understand. It’s why boring cash flow properties can make you rich.

Sorry to hear about your relative’s horror story. There are always things that are outside of your control, so the cushion is a must! It also helps to remind myself to not get greedy – yes I can scrape together enough money to purchase more properties, but it’s not smart to my spend cash reserves.

Hey Brian,

This is a great article. Good explanation of the benefits of leverage in real estate.

I am also a strategic user of leverage, and I am comfortable with the risks. You hit on one of my main factors – the property and market. The worst deals in the past for me were leveraging too much on bad properties. My higher LTV loans on quality properties were less of a problem because I could liquidate when needed. My lower-priced properties or multiunit properties were less easy to liquidate, and therefore more risky to borrow against at higher LTVs.

The loan terms also make a big difference in how high I’m willing to leverage. Conventional, 30-year loans like you’ve mentioned are great. You can weather a lot of storms. But properties like mobile home parks and apartment buildings are not as easy to leverage with great terms. When you start adding balloon notes to your portfolio, the worst case scenarios start getting a lot worse (as many banks and real estate investors found out in 2009). That makes me more conservative about leverage on those types of assets.

Exactly. I do 30 year fixed rate mortgages for the certainty. Yes are able to get a better rate with adjustable rate or complicated balloon payments, but it adds a bunch of risk.

I’d love to hear more about how the low-priced properties have been harder to sell. Many people who first get into turnkey investing don’t understand this. What have you found to be your sweet spot?

It depends upon the specific location, but for single family rental houses I like ones that retail between $90,000 – $170,000. That’s +- 30% from median in my area. It’s a good combination of rental income and liquidity.

In that past I would also dip a little below that $90,000 threshold, to maybe $70-80,000 retail, and do owner financing. Dodd-Frank Laws changed that deal for the worse, but you can still do a couple of deals per year like that and make some really good profits holding notes.

That’s great to hear – you have a pretty big sweetspot of 20-80% percentile home prices. Some people advocate gaining expertise in one specific type / area, it sounds like you use your experience to your advantage by taking good deals where they are available.

Hi Brian,

I am so glad you wrote this article as I have been struggling with this. To me, leverage equals risk. Granted it can be calculated risk. Right now, I have quite a bit of money saved, which I initially was going to put a sizable down payment on a home here in Southern California. Now, I am thinking maybe I should continue to rent and pay in full a rental in another state. According to your article, I am taking this as it might be better to spread it across four or five rental properties (20% down) . If this is so, THIS is what makes me nervous. The significant increase in risk. If any of the renters stopped paying, I would have to come up with the money, including money for the house I would be renting. This is the biggest source of concern for me.

Thanks for sharing your current thinking. Obviously there is more than one way to look at it, but here is my thinking.

Down payments for a personal home is an expense for something you use. It’s not really an investment. A larger downpayment can lower your future expenses a bit, but it is still an expense. In a sense, the extra downpayment is like contributing money to a savings account with a few percent interest.

Multiple rentals can spread out your risk – if you have a vacancy, your other properties can help cover it. Rather than a full 4 or 5 properties, you can keep a larger cash reserve to make sure you get through any tough times. So maybe only go 2 or 3. The cash reserves and cash flow numbers determine how risky the investment is, not how much the loan balance is.

Hey Brian – quick note for editing that got me super excited b/c I thought I had missed a great opportunity! 🙂 You wrote: “The lending limits right now are 1:5 ratio for your first 4 investment properties (2% down). For properties 5-10 it is a 1:4 ratio (25% down). ” I think you mean “20%” down for the 1:5 ratio. No need to publish this comment, just an fyi for fixing. Great post!

Thanks for letting me know, I just fixed it.

I like the example you gave explaining leverage using scotttrade. Real estate is a big opportunity to make some good cash flow, and many people realize this, they just dont have the mind set to follow through with all the steps to get that cash flow. From pre qual, to lending, to closing, and to finally finding a PM. These are all the limiting factors I hear from people all the time.

Yes, there are so many reasons for someone to decide they can’t do it. Each individual step isn’t that hard, but it can stop people from even getting started. For the first property I promote going through an investor network that refers to the best turnkey operators (I went through Jason Hartman) – they will have multiple options for you for lenders, turnkey companies, and property managers. It makes it much easier and way more approachable for a beginner.

Doesn’t that math equal 44,638?

Great catch, it absolutely does! Those numbers in the spreadsheet were rounded to the nearest dollar though, so I don’t think it was a subtraction error by the spreadsheet.

I see how you setup buying and leverage-Do you have a procedure for selecting a lender and terms?

My best experience was with Aaron Chapman (https://snmc.com/lo/aaronchapman/?CID=435) so would recommend having a conversation with him. Check out Bigger Pockets for more. Not sure what you mean on the terms – I like 30 year fixed for certainty with leverage.