I’ve connected with many rental property investors since launching Rental Mindset. Why are so many rental property investors engineers?

As I think about the dozens of rental property investors I’ve met in the last year, I’ve noticed many are engineers.

Examining data, patterns will start to emerge. Are those patterns telling of some information or just random chance?

What does it say about the traits of someone who self-selects those two groups? Are there any conclusions we can make about who will be a successful real estate investor?

Be careful examining two independent variables

Science starts with a simple observation about the world, a hypothesis for why things are the way they are, then trying to design an experiment that isolates just one variable.

It doesn’t stop with a just an observation because …

Correlation does not imply causation

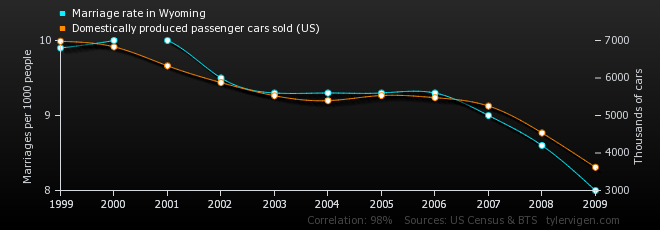

For example, bet you didn’t know the marriage rate in Wyoming moves in step with the domestically produced passenger cars sold in the United States.

It is easy to form a hypothesis about why those independent events are linked: “Well when you get married you start a new life together and will often get new things – a new house, furniture, and even cars. And Wyoming is the most American state, so most the cars they buy are American made.”

Similar stats could also be applicable to other states and cities. People buying a new house or renting one might look for movers mechanicsburg pa, for services such as junk removal, storage facility, or interstate movement. In addition, relocating families may also require lots of new supplies.

Humans are really good at rationalizing. Perhaps we should be more like this guy:

The truth is often somewhere in the middle.

Engineers and Rental Investors

Digging into this, my first thought is to visualize how big each of the Venn diagram circles are. Are there more engineers or rental property owners?

There are a lot of engineers out there. This says 19.6 million in the United States with a bachelors degree in science and engineering.

There are a ton of rental properties in the US. 43 million households rent (source), with 76% of those being 1 to 4 units (source), with 92.5% owned by individual investors (same as last source). This says there are 22.8 million landlords in the United States. (So the average is to own 1.3 units? That doesn’t sound like very many. I’m above average!)

Wow, so those two categories are extremely similar sizes. Roughly 20 million people in the United States, 8% of the adult population.

How Much Overlap?

This is where things get tricky. I don’t know that we are going to come up with an accurate answer, but let’s dig in.

If the two variables (rental investor and engineer) are not related at all, we would expect that 8% of engineers own rental properties and 8% of rental property owners are engineers.

It has to be way more than that.

I would guess 50% of rental investors are engineers. However, since the two groups are the same size, would I state that 50% of engineers own rental properties? No way.

Unfortunately I don’t know if the census data allows for doing an AND on two different variables like this. That would be ideal.

If we really cared, we would poll a statistically significant portion of those groups and extrapolate.

Unfortunately this is as far as we’ll go for now.

Overlap in Traits

My anecdotal evidence talking to dozens of rental property investors points me towards that 50% estimate.

Simply listing the characteristics of an engineer and a rental property investor also point us towards significant overlap. The stereotype of both are nearly identical.

Both are good with numbers, logical, and prefer tangible things they can touch (as compared to options trading or theoretical physics).

How many people are good with numbers? Comfortable with math? I bet shockingly low. That trait alone is likely highly correlated with engineers and rental investors.

What about you?

Help me gather a bit more data.

I know what it is like to be an internet lurker, but this time, actually leave a comment!

Do you have any rental properties? How about an engineering background (even if not employed as an engineer)? What would you estimate is the overlap between rental property investors and engineers?

Intriguing hypothesis, Brian!

Well, although I used to be in the tech business, I’m not an engineer. But, I do own a few rental properties.

I’m interested to see what other readers reply with. 🙂

I think you qualify as the technical-type. The engineer label was determined by undergraduate degree, but I don’t know if that is the most accurate. If looking just at college I would probably include econ, with spreadsheets and lot of calculations. In the real-world, IT might be wise to include too. Still very logical.

I was hoping there would be a comparison of pirates and global warming ;-).

Here’s our anecdotal story. I’m an engineer (maybe ex-engineer?) who has rental properties. My wife, a military pharmacist, got a big job opportunity on the other side of the country in 2006 and it didn’t make sense to sell either of our condos. We became rental investors because it made the most sense.

So maybe there’s an “accidental” rental investor to add to the mix.

I’ll give you one more thing to chew on. Back in 2007 or 2008 there was a poll on the major forum of personal finance writers. It was simply, “Are you an engineer, yes or no?” I think more than 100 people responded and more than half were “yes.”

I chalked it up to tech hurdles of setting up a blog, and finding the forum. Even considering that, it seems much more than chance.

Accidental rental properties count! I think it is a lot of the same skills evaluating that decision whether it made sense. Engineer logic!

That’s an interesting poll of personal finance writers! Most the commenters are bloggers, but people who sign up for emails and reply aren’t. So it’s a mixed bag, but I suppose I don’t necessarily know the career of the people who email, so maybe my perception leans towards people with blogs.

2 engineers here…2 rental properties. (more to follow).

Double double!

My undergraduate degree was in engineering, although I don’t work in the field, and I anticipate buying my first rental property this year…

Awesome. I studied engineering too but didn’t really go into it.

Congrats on the first rental! Local or far away? What info would you like to know that I can help with?

Hey Brian!

It’s very interesting that you’ve noticed this! I’m an engineer and think that the engineering mindset really does increase one’s propensity to investing in real estate. Like you said, we like real, tangible items. They just make sense to us. That and having relatively high incomes make more engineers able to invest in real estate than a lot of other professions.

Cool food for thought!

That is a good point too – you can’t invest without money, which limits the pool of people to begin with. Engineers are a large portion since almost all have a pretty good income.

We have noticed that fellow real estate investors tend to have a more analytical mindset and/or professions. Many are programmers, statisticians, accountants, financial/operation managers, tech specialists, etc. Or, they are individuals who are well-known by family/friends for naturally being very analytical, detailed, and organized and often make lists, spreadsheets, and files to plan/categorize different aspects of their lives. In our friend/family circle, our more analytical friends seem to be more hands-on with their investments whether it be rental properties or the stock market or local businesses. Whereas, our less analytical friends seem to prefer ‘lower risk’ and less involved options like auto paycheck deductions into an index fund, or they might hire financial advisers for guidance. Fortunately, there are various routes to financial independence and/or a comfortable retirement.

For the record… My husband and I both have computer information degrees and own 3 rentals with plans to pursue more later this year. Our 26yo son has 2 rental duplexes and is a researcher who majored in economics. My in-laws work in pharmaceutical development and are highly organized individuals who also own rental property.

Excellent, thanks for adding so many data points. Organized and spreadsheets is a great point – I wonder if that broadens the circle to include numbers-heavy project managers, supply chain, logistics workers etc.

Plenty of routes to get to financial independence, but some are more advantaged than others! I hope to earn 20% a year on my rental portfolio, which really speeds things up (I’m at 29% yearly return right now, but had some lucky timing contributing to that number).

I’m an engineer married to an engineer…and we have 5 rental properties!

Another 2 engineer family with rentals! Congrats on your 5, are you doing local or out of state?

4 plex and townhouse local (Central PA), 2 SFR’s in Indianapolis, 1 SFR in Philadelphia

Excellent. A good combo, very diversified.

3 rentals acquired as foreclosures in the past 2.5 years and looking to add more. Safety Engineer.

Awesome! How did you get into foreclosures for your first properties? Do you know someone who does them or work in a related field? Just curious!

Brian –

I met a Real Estate professional who has auction experience and related businesses involved in it, I first started by funding hard money loans secured by real estate to generate income and establish business relationship. After that worked well I purchased some myself and pay small commission. Post acquisition, she also has companies who do the renovation and handle the property management as well, so it’s a win win for both of us. It’s as close to completely passive as it comes for me.

We try to investigate what your buying but there is limited time for that (24 hours) and often times you can’t see inside the windows so it’s a leap of faith. Opening the door is interesting! One I got real lucky and spent maybe $250 to renovate and had a renter in there in 4 -5 weeks thats coming up on 2 years now. The challenge lately is finding the next one that cash flows — prices keep increasing in my area.

Wow, that is great! I was going to say, kind of advanced for a first timer to jump into, but sounds like you met a great partner! That is pretty similar to the turnkey model, but you come in pre-acq rather than just when the rehab is finished. It takes on a little bit more risk, but I’m sure you end up with a better deal for it.

Prices are definitely up! I approach it as always a good time to buy, but not in every area. So if your local area doesn’t cash flow right now, look to a more linear area. The more boring the city (with steady jobs), the smaller the downside: https://rentalmindset.com/lets-visualize-real-estate-cycle/

how about physicians or health care workers who invest in real estate?

physicians are a smaller % of the population but if you include nurses, techs, etc..you may also have a big pool of one sector investing in real estate.

One of the biggest (if not the single most important) is have excess cash to invest.

which means income>expenses. Either you increase your income or decrease your expenses.

Have you observed a big portion of doctors invest in real estate? I personally haven’t talked with many, but my experience may differ.

Engineers make the best real estate investors!

I talked with former aerospace engineer sarah may who became passionate about real estate investing, built up a rental portfolio, and has now moved into syndicating larger multifamily deals. She works with a great group of investors helping people move their money out of the stock market and into physical assets — real estate.

Some dialogue from the show:

1) How much simple passive Cashflow are you making today and how are you doing it?:

My husband and I are making about $6–7k/month in passive cash flow from our 10 properties (22 units).

2) What is your Han Solo moment? Describe the resistance that was the catalyst for change:

For me, the main factor was knowing I didn’t want to stay in my then-current career path for the rest of my life. I had already been a student of real estate for several years, but finally I knew that if I didn’t want to be tied to an unfulfilling job for the rest of my life. I had to take action and starting building passive cash flow to support my lifestyle. For me the combination of desire + education = action.

3)Did you “burn the boats” or did you let it happen naturally? — was there an internal (you decided to make a change on own — what was thought process?) or external trigger (ie got fired from your job)?:

One thing that I’m incredibly grateful for is having a like-minded husband who I can brainstorm with. We both knew we wanted to build income from real estate, but we weren’t sure how we wanted to do it at first. Things happened fairly naturally, but it was a bit of a journey getting to where we are now. Our first “investment” as a married couple was a house we decided to fix up and sell. That was a major learning experience, and the biggest thing we learned was that we didn’t want to be house flippers!

After putting tons of sweat equity in the deal (even though we had a general contractor), we made less than $10k of profit on the deal. If we had kept it as a rental for just an extra year, we would have made $40k more from appreciation. Today, 5 years later, that house is worth nearly double what we sold if for after fixing it up. After that experience, we saw buy and hold real estate as the tried and true method of building wealth relatively passively, so we set the goal to buy 2 properties (2–4 units) per year and for the most part have stuck to that plan, and it’s worked out well.

4) Worst life/business moment what did you do after? Lesson learned?:

I’ll have to go back my previous example with the house flip. The main lessons I learned were not to use the same contractor as your house-flipping realtor since it creates a major conflict of interest, and also that you can make more income in a less stressful way by owning cash-flowing rental properties. I also learned that strong contracts can make all the difference in a sticky situation.

5) Current 2-week experiment and 6-month project? (90–180 day goal):

A mark of a high performer is to put your ego aside and accept the help of others and mastermind maybe folks can help you by you asking. My current 2-week experiment is to get my son to eat his vegetables! Just kidding, in reality my next big 2 week goal is closing on our 100 unit apartment syndication. My 6-month project is get the repositioning of the apartment community well under way and get into a good business rhythm.

We’re going to do a major remodelling project on the unit interiors and improve the property overall by adding covered parking, backyards, and a spruced-up office. Maybe in 6 months we’ll even have another property under contract by then!

6) What is your simple passive Cashflow number? Now imagine you had 2x that amount… Describe your ideal day, detailed routine, and what projects you are working on:

My current simple passive cashflow number is $6–7k/month. My goal is $12k/month. Twice that amount would open up new opportunities. My ideal day would involve some sort of time outside, exercise, a good cup of coffee, involvement with friends and community, self-development like reading books, and plenty of time with my husband and son. We’d go on quarterly vacations and also monthly mini-vacations hiking and camping near our home. I also would probably keep working on real estate!

7) Something that you have recently done or thought about “burning your cash” on for time savings or an improvement in quality of life:

Right now I’ve been focused on using my cash to buy great real estate investments. If I had to splurge on something, it probably would be a new car. My 2004 Saturn is starting to show age! Typically though, I’ve mostly spent my extra cash on things like vacations where the memories will last far longer than some new gadget.

8) Something that you changed your mind on?

Our ego often gets in the way of greatness. One lesson I’ve learned over the years is that sometimes, it’s okay not to have the nicest property on the block. Especially when it comes to rental property. There are plenty of people out there who need a safe, clean, functional place to live. We also have Section 8 tenants at some of our properties, and while I was very apprehensive about it at first, there are definite advantages. Also, these types of properties typically provide much better cash flow than the newer “Class A” buildings out there.

9) Tony Robbins identifies two large concepts that we are continually struggling to gain perfection at: #1-Art of Fulfillment and #2-Science of Achievement. If you died tomorrow and I were to email this to your kids a couple decades later… this is what they would hear:

a) What is your secret/hack for the “Science of Achievement?” Any secret habits to share? Morning or Nighttime ritual?:

I think the “Science of Achievement” for me can be summed up in one word — Perseverance. For me, I think I’ve been successful because I refuse to give up. Whether it was a tough homework assignment, a seemingly impossible-to-meet deadline, or navigating my first real estate deal, I found that if I kept at it long enough, the impossible became possible.

b) What is your secret/hack for the “Art of Fulfillment?” How you do contribute back?:

For me, the most fulfilling parts of the day is the time I spend with my husband and our 2-year-old son. I’m fulfilled by having a multi-dimensional life where I love working on my business and real estate, I love exploring the Colorado outdoors, and I love spending lots of time with my family.

Love the Han Solo moment haha!

You got me! I have an engineering degree, and I am hooked on real estate. I love crunching the numbers on deals. I don’t get the same enjoyment out of thinking about our investment accounts that I do running numbers on real estate deals. Maybe it’s because there’s more chance in how our investment accounts will perform, but with rental properties I can get a good handle on what the numbers should look like. And I can run numbers on what making improvements to those properties should do to our bottom line.

Yes! The numbers are way easier to understand than a corporate balance sheet – it even makes the math fun, figuring out how much money you can make.

I’m excited to follow you site!

Hi brian! I am so emotional right now! I dont know why! I am 18 yrs old turning 19 this february, and I’m planning to take up mechanical engineering next fall semester! I’m really ambitious about being a successful real estate investor one day, and hopefully i can meet people who shares the same passion and interests as I do. As of now, Im reading books about cash flow, and things I need to know about real estate(and accounting terms like equity income statements etc) in order to propel me in the future!

I wanted to seek help from my family in terms of financial needs cause I really want to try if i can invest with little money, cause what i want right now is to experience it. However, they just dont have the same mindset as I do, even my sister. So I’m trying to fortify my knowledge about terms and strategies in real estate, and hopefully share it with a mentor or with someone and we would work together as a team (an important business principle) and be successful together!

I’m glad that i get to see full time engineers commenting on your page, I feel inspired and pumped! If any engineer/ investor see this, hopefully I get to be like you guys one day!

That’s great to hear – both a future engineer and real estate investor!

I’m really glad for bumping in your website. I would love to hear an advice from you on whats the best approach of putting myself “out there” as a young individual. I can read many financial books regarding about real estate, but I know having an outside experience of what is it all about is the most significant factor in being a successful real estate investor.

That’s a good question! I would say look for some in person meet ups to surround yourself with others who have more experience. And don’t be afraid to pick up the phone. You can learn a ton by calling realtors, property managers, flippers – often you’ll find they are willing to answer a couple quick questions. And there are so many of them, if one won’t try another!

great article and comments. Engineer here with 17 properties. wife is engineer but does not like rental properties haha. Just a risk tolerance thing. Biggest piece is for me was that I understood the value of self-discipline and delayed gratification. If you go through engineering school you definitely understand delayed gratification, sacrifice now for better future. The problem is when you say sacrifice now for sucesss with you are 59 1/2. that is where most look for faster, now immediately but better 10 year plans. People usually choose gambling, stocks, real estate, or start their own company. i think real estate is king.

I agree – the message of waiting for retirement doesn’t work that well. Set a 10 year goal, delayed gratification. Real estate is perfect for that and achievable by almost everyone. I love starting companies too, but it is way harder. My thought is that owning rental properties can actually show you more small business opportunities. You’ll work with many – property managers, leasing agents, appraisers, handymen, etc – and potentially realize it isn’t that hard to offer a service.