On a typical day, I don’t give my rental properties any thought. There is a property manager to collect the rent and handle any repair phone calls.

When the property has a tenant in place, it is pretty typical to just have one email or phone call with the property manager per month. Or zero. Hardly any work at all.

But when I look back at the last 6 months, some trends start to emerge – this analysis is a great chance for me to realize what I need to do.

My goal is to show potential investors the two sides of the coin. It’s not that hard and it’s a pain. Somehow both are true.

Managing Your Manager

The goal of the investor is to make sure their property manager is doing their job. This is the case when you look into their hoa compliance, and when you consider what their work means. The rent is collected and deposited into your account. They handle all tenant calls and minor repairs without discussing with the investor. Instead, there is a short month summary sent.

Most of these details were pulled directly from the monthly summary email. Then I sometimes follow up by email or phone for additional information – what was the repair in more detail? Are there before and after pictures?

I also double check the money was deposited and matches up with the report – just generally keeping an eye on things.

The Bad – Late Payments

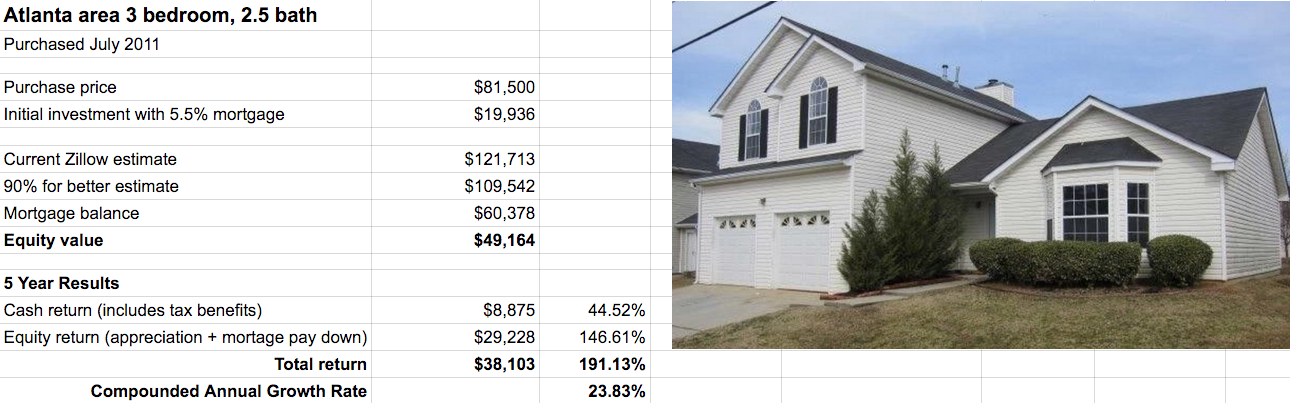

The Atlanta tenant has been in the property 5 years now. This really helps cash flow because as we saw with the Memphis property, tenant turnover is very costly.

But slowly over the course of 2015 the tenant fell behind on payments. Rent is due on the 1st of the month and she paid a week late. Then the next month it slipped another week, compounding the problem. Some months were on time, but the issue peaked at nearly 2 months late on payments.

We were perhaps a little more lenient than we normally would have been since this tenant had a four year history of paying on time. But we weren’t push overs.

Twice when she said she would have a payment by a certain time, we filed the eviction paperwork. Both times she caught up enough and paid the paperwork fee on top to keep the game going.

The Good – All Caught Up!

After an entire year various levels of behind on rent, then tenant is now caught up. So rather than exactly 6 payments of $950 for 2016, the tenant has paid much more – $7,665 towards rent, plus a little more for late fees and the eviction paperwork expense!

This is really going to help the cash flow numbers for 2016. It balances out the disappointing cash flow numbers from last year.

Rent payments the last several months have been on time and we won’t let that happen again. But I’m glad it worked out!

The Bad – Repairs

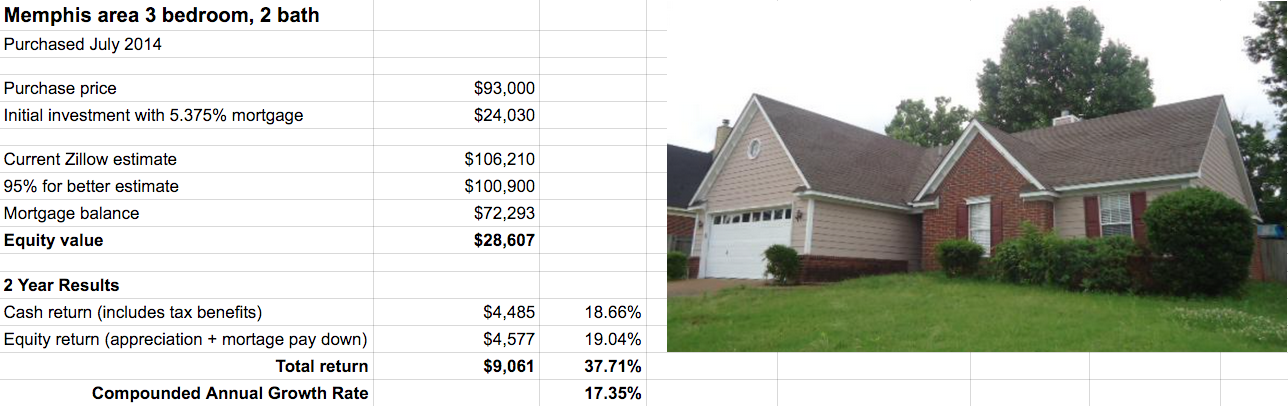

I already covered the process of placing a new tenant in the Memphis property through January and February. There were several repairs that were done to get the property ready for a new tenant, but let’s cover what has happened since then.

Even though a lot was done in January, there were still quite a few repairs that weren’t all that cheap:

- Replaced fill valve in master bath and hall bathroom. Repaired broken commode collar. $373

- Repaired closet shelves and re-secured fan. $111

- Water heater T-and-P valve. $99

In Atlanta there were some storms that damaged shingles and vinyl siding, but this could easily be repaired by looking for siding replacement alpharetta has to offer (if I were closer to this area). But as this is Atlanta, I’m going to have to find a service closer by!

The property manager pushed off making these cosmetic repairs until they were completely caught up on rent, which was a great move. She finally sent someone out to do the repairs and the total came to $245.

The total repairs for the last 6 months, excluding the expensive tenant turnover, were $828. Ouch!

My rough budget for repairs is $70 per month per property, which comes to $840 for the half-year. I went well over including the repairs not billed to the previous tenant during the tenant turnover. However, it is lucky that the valves for the water heater were found, otherwise, I’d have had to look into websites similar to bouldenbrothers.com/water-heater-replacement/ for a full water heater replacement, and that would have increased the total bill significantly! Then again, if a problem with a water heater cannot be resolved then a replacement may be necessary – it’s either that or no hot water! However, most problems can be rectified with some assistance from plumbing experts – navigate here to learn about some of the problems they can help with.

The Lazy

I believe I am paying too much for property management and repair mark-ups in Memphis. But I haven’t shopped around for a new property manager or decided to try self-managing yet.

I discussed raising the rents with the Atlanta property manager a couple months ago. It still hasn’t happened. I guess I haven’t followed up frequently enough to make it happen.

The insurance costs have gone up from roughly $600 to $850 a year on the Atlanta property over the course of 5 years. I know I should shop around for new rates, but haven’t done anything yet.

Part of this laziness is not wanting to rock the boat during a busy time in my personal life – the last thing I want to do on my honeymoon is deal with any issues that could come out of raising the rent (like a vacancy) or changing property managers.

As a result, I’m leaving a little bit of money on the table each month.

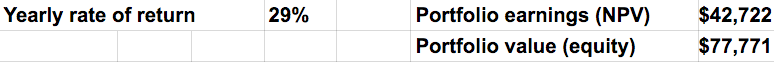

Overall: Pretty Solid

Extra rent money, more repairs than expected. I still come out ahead over the last six months.

What do you think? Was this a good first half of the year or would you be disappointed by this?