Have you ever heard of someone wearing a tin foil hat to protect them from mind control, radiation, or aliens sucking out their brains?

Yes, this is a real thing that some wackos believe. I love a good conspiracy theory, but stop short of actually believing them. (My favorite is the Denver Airport Conspiracy Theory – I try to watch it whenever I am flying through there, makes travel fun.)

I hope you aren’t wearing any tin foil right now. If you are, you can get a stylish upgrade with this Kickstarter campaign.

But are there other areas in your life where you have an irrational fear? Is it holding you back?

Fear of Managing

The biggest misconception about rental property investing is that you have to be a landlord and it takes a lot of work. People are frightened of this.

Good news – you can pay a property manager to do most the work for you! You don’t have to be a landlord, you just have to manage the manager.

Yet this is still scary to some people. What if they do a bad job? What if they charge too much for expenses? What if I have to fire them? What if what if?

Yes, there is a bit of a learning curve. I am not very far along this curve myself and things are working out fine. As I get more experience I’m sure I will improve my skills at identifying a great property manager and learn better ways to work with them. It’s ok to not know everything before getting started.

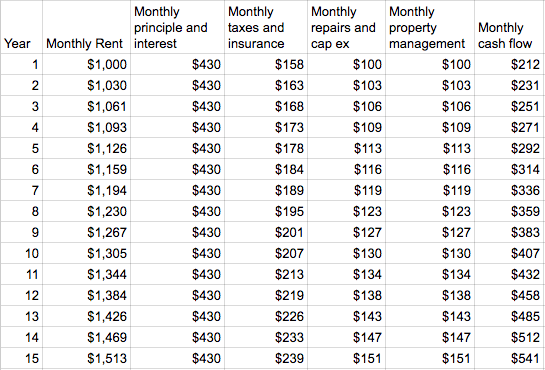

Gosh that still sounds annoying, why would anyone want to do that? Simply because the benefits outweigh the effort.

Before saying “this isn’t for me”, shouldn’t you know the results you are passing up? Can you make a 20% to 30% return elsewhere without any effort? Is a little bit of your time worth these amplified returns? Absolutely.

This effort required is actually a benefit – it keeps the masses away! Do you think the opportunity would be there for you or me if Wall Street could high frequency trade rental properties? Take advantage of this.

Everyone Hates Taxes

What if your tax bill went up from $20k to $25k? Would you be upset?

How about if it was because your income went from $80k to $100k? Still mad?

Can the irrational fear of paying more in taxes actually hold you back from earning more? Yes, it certainly can, which is why many people often consult tax advisors (perhaps they search for them by looking up keywords like tax consultants near me). It is true that most people are oblivious to the tax deductions they are eligible for. That is why taking the help of tax advisors can help them to save taxes and ensure that they are done correctly.

Anyway, coming back to the topic, I was discussing how crazy this is (the matter of tax) with my friend who does estate planning (the kind you can see on this website). Here is what he said:

Agreed, although my recent experience has been that this is a big mental barrier. I have several clients who have received ridiculous offers for their properties but have difficulty accepting the capital gains. It’s a great problem to have because it means the investment did well, but there’s a mental barrier that taxes are bad (which they are, but not if it means you had a huge gain). It’s not rational, but a couple of the clients have been extremely rational people, including the world’s most stereotypical engineer.

How it Applies to Real Estate Investing

When you invest in rental properties there are all sorts of tax advantages. Obviously consult an expert, not a random dude on the internet, but here is a quick explanation of how it works with capital gains.

A capital gain is when the price of your asset goes up. With a stock, if you buy at $20 and sell at $30 a couple years later, you have a capital gain of $10. You will pay taxes on that profit.

Same with real estate. Except there are some tax breaks you can take advantage of.

First, you can sell a property and buy a new one while paying no taxes with a 1031 exchange. So you can trade up and go from high effort properties like low-cost C neighborhoods to a class A duplex that requires less work. However, make sure to do your share of research into things like what a duplex is and how investing in it could be fruitful for you.

But all this time the potential capital gains are growing. That means you made money and if you sell, you will have to pay taxes on it.

Or another option is to not sell and hand it off to the next generation – they won’t have to pay all those years of capital gains. It goes away as the buy price “steps-up” to the price upon death.

Yet these potential capital gains taxes hold some people back from investing in real estate! Unfortunately for some, they have back taxes that are unable to pay off to get on the real estate ladder, as they may have made some wrong choices a while ago, stopping them today. You can learn more about how to deal with these back taxes by checking out websites such as taxrise.com and reading their articles on this area.

Is Your Fear Irrational?

Is a potential issue down the road holding you back from ever getting started on your journey?

The thing you need to ask yourself is – when I reach this obstacle, will I be able to figure out a way to solve it? Notice this is different than asking if you can solve the obstacle today.

You will learn a lot on your journey and be able to consult experts when the time comes. You don’t have to know everything right this second.

I encourage you to get moving on a conservative path to start your learning journey. Hit the bunny slopes first and gain valuable experience. Don’t look at an advanced obstacle far down the line and let it stop you from ever getting started.