Hundreds of millions of people have marched into battle and died.

Jeez that’s a heavy opener. I really hope I can turn this article around, wouldn’t want everyone to leave depressed…

Do you ever wonder – what the heck were they thinking? Looking back, a lot of those wars didn’t matter. Worse still, most of the deaths were on the losing side, so it’s not like their death affected the outcome. So why bother?

The human mind is amazing – somehow we are able to convince ourselves to march into battle to meet nearly certain death. Let that sink in for a second. Wow.

How do we harness that power?

A Bigger Purpose

Each and every one of those men who died in the wars had their own reason. A purpose.

It might have been protecting their family or homeland. Or stopping injustice. Or spreading their religion so more can access heaven.

It might have been more personal, like proving their manliness. Or earning money to feed their kids.

With a big enough purpose, we can take any action.

Start With Why

There is a great Ted Talk by Simon Sinek “Start With Why”.

It is about how successful leaders and organizations inspire others. But it is just as powerful thinking about this for ourselves. How do we inspire ourselves to take action?

You need to know why! Not just what. Not just how.

Taking Action in Rental Property Investing

Most people on this website already know what – they want to invest in rental properties.

Some even know how – the steps necessary to get there.

But I bet you won’t take action without knowing why. There are too many obstacles in the path to just waltz right in and be instantly successful. You need a purpose for motivation.

What is Your Why?

Take some time to think about this.

Why do you want to invest in the first place? Why do you want cash flow or passive income? Why, why, why?

If your answer is something like “so my money works for me”, you need to keep going. Keep chaining together whys until you get to something that gets to your purpose or identity.

I want freedom and flexibility – not a standard job where I have to show up every week for the next 35 years. I want to be able to spend time with my family with the ability to take days or weeks off when I want. The time freedom to put family and friends first rather than being too busy. I want the ability to control how much money I make rather than just whatever the employer decides to give. The flexibility to earn more if that’s what our family wants or needs.

That is why I want the passive income and wealth from rental properties.

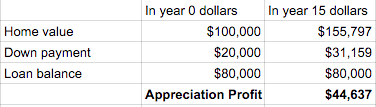

That is what gets me through the scary aspects like writing my first $20k down payment check.

That is what gets me through the tough days when there is a repair or tenant issue.

It is a powerful why.

What is your why?