Have you heard of Hotdogs or Legs? It’s an Instragram hashtag to see if you can tell if a photo is of legs or actually two hotdogs!

I’m in Mexico chilling on a beach, so you are going to have to go without a new article this week.

If you miss me, grab a margarita and try my ‘mexico we go’ Spotify playlist.

Let me also point you toward a couple things you can learn while I’m away killing brain cells with too much mezcal.

Understanding Money

I don’t have an econ background, nor do I think anyone really understands it. I mean no matter how much macroeconomics you know, it isn’t going to make you a great predictor of what is to come.

Yet you don’t have to understand it to benefit. Inflation is what a leveraged rental property investor wants AND it is what the US government wants.

Check out my article digging into the numbers Inflation: The Great Mortgage Destroyer.

Understand how it is measured, so you can decide if the published numbers match your reality:

Understand why governments create inflation:

How will unfunded entitlements be paid? With a dollar that isn’t worth a dollar anymore. With inaccurate CPI adjustments. Who benefits the most? Leveraged rental property investors!

Check out more videos about Inflation and Quantity Theory of Money.

Around the Web

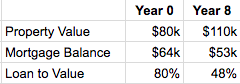

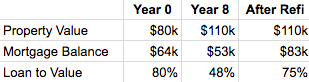

Coach Carson is a real estate pro and great writer. I love his graphics that break down complex numbers into something you can easily visualize.

He wrote a series of articles about different ways you can succeed with rental properties. It isn’t one size fits all. The one that is closest to what I recommend?

The Trade-Up Plan – How to Retire in 8 Years Using Tax-Free Exchanges

Eric Bowlin is another full time investor I met last year at Fincon. I fully expect him in 10 years to be a big baller. He is going places and sharing his knowledge.

The most common excuse of not getting into real estate is no money. Check out How to Raise Cash Like a Champ For Your Real Estate Deal.

Sam at Financial Samurai is already financially set. He wrote an article Focus On Trends: Why I’m Investing In The Heartland Of America. Check it out, it is a great read.

I agree with the premise to invest in heartland real estate, but recommend you go about it a different way. For most people being a direct owner is way better than crowdsourcing like RealtyShares. You want to be financially stable in what you are planning on investing in, especially if you are intending on passing this on to future generations, so you’ll need something like a Trust and Estate Attorney to keep everything in line and legally above board, so be aware and remember to take precautions where needed.

Michael at Financially Alert is one of my best internet friends. Yes, that’s a thing. He has a couple of rental properties that are doing very well. I cannot possibly tell what strategies he uses or how he keeps the property maintained to always make them look lucrative to potential clients. Of course, he must be ensuring the houses are painted, locks changed (he may have to find a local locksmith, for that matter) and pests removes (if any!) in between the moving out and moving in of the two sets of tenants, but to give you a correct estimate, I would have to consult him.

You can check out how he rebounded from a poor start in My First Rental Property was a FAT Failure.

Up Next

I’m going to be sharing the actual numbers of my cash out refinance.

If you haven’t read it yet, start with my article Let’s Double Down! Cash Out Refinance on a Rental Property. This will make sure we all start on the same page for “why” before we get into “how”.

I want to hear your thoughts, just don’t expect a reply until I’m back in San Francisco:

- Do you think there will be much inflation over the next 30 years? Is it under-reported by the government by even 1% a year?

- Do you have any real estate websites you follow that I should check out?

- Is there anything you are specifically interested in learning about my cash out refinance?

Photo: justsayu