I’ve connected with many rental property investors since launching Rental Mindset. Why are so many rental property investors engineers?

As I think about the dozens of rental property investors I’ve met in the last year, I’ve noticed many are engineers.

Examining data, patterns will start to emerge. Are those patterns telling of some information or just random chance?

What does it say about the traits of someone who self-selects those two groups? Are there any conclusions we can make about who will be a successful real estate investor?

Be careful examining two independent variables

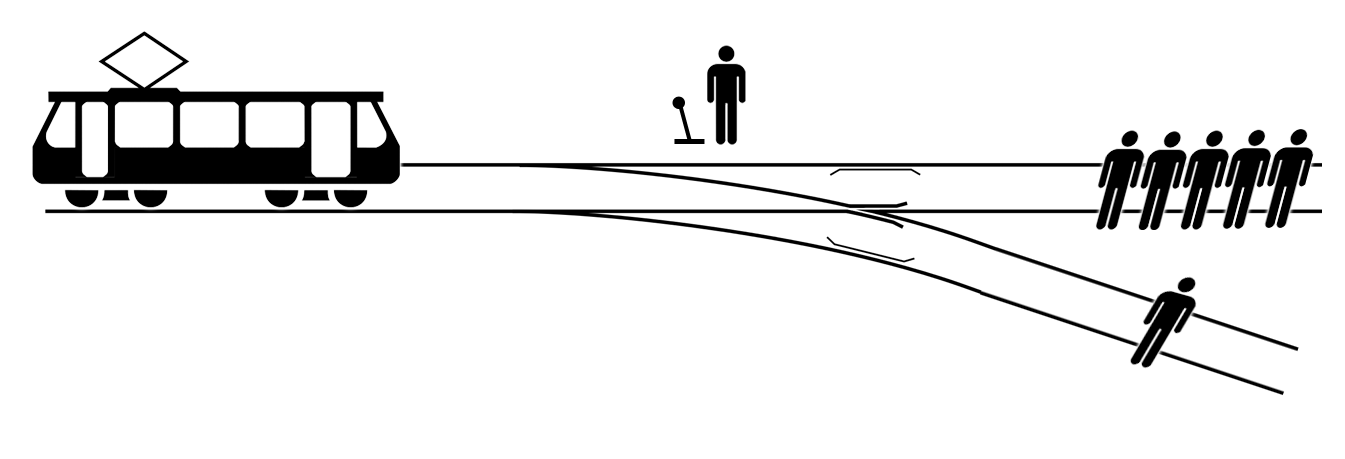

Science starts with a simple observation about the world, a hypothesis for why things are the way they are, then trying to design an experiment that isolates just one variable.

It doesn’t stop with a just an observation because …

Correlation does not imply causation

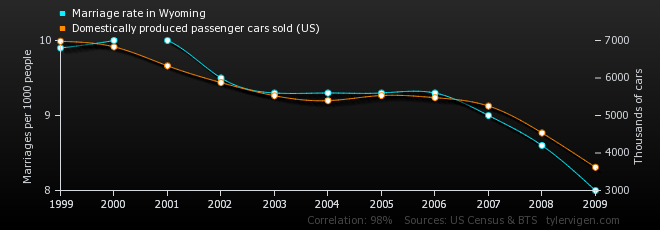

For example, bet you didn’t know the marriage rate in Wyoming moves in step with the domestically produced passenger cars sold in the United States.

It is easy to form a hypothesis about why those independent events are linked: “Well when you get married you start a new life together and will often get new things – a new house, furniture, and even cars. And Wyoming is the most American state, so most the cars they buy are American made.”

Similar stats could also be applicable to other states and cities. People buying a new house or renting one might look for movers mechanicsburg pa, for services such as junk removal, storage facility, or interstate movement. In addition, relocating families may also require lots of new supplies.

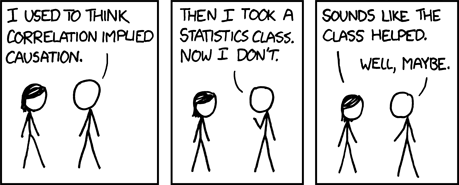

Humans are really good at rationalizing. Perhaps we should be more like this guy:

The truth is often somewhere in the middle.

Engineers and Rental Investors

Digging into this, my first thought is to visualize how big each of the Venn diagram circles are. Are there more engineers or rental property owners?

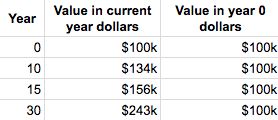

There are a lot of engineers out there. This says 19.6 million in the United States with a bachelors degree in science and engineering.

There are a ton of rental properties in the US. 43 million households rent (source), with 76% of those being 1 to 4 units (source), with 92.5% owned by individual investors (same as last source). This says there are 22.8 million landlords in the United States. (So the average is to own 1.3 units? That doesn’t sound like very many. I’m above average!)

Wow, so those two categories are extremely similar sizes. Roughly 20 million people in the United States, 8% of the adult population.

How Much Overlap?

This is where things get tricky. I don’t know that we are going to come up with an accurate answer, but let’s dig in.

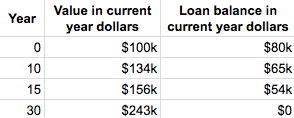

If the two variables (rental investor and engineer) are not related at all, we would expect that 8% of engineers own rental properties and 8% of rental property owners are engineers.

It has to be way more than that.

I would guess 50% of rental investors are engineers. However, since the two groups are the same size, would I state that 50% of engineers own rental properties? No way.

Unfortunately I don’t know if the census data allows for doing an AND on two different variables like this. That would be ideal.

If we really cared, we would poll a statistically significant portion of those groups and extrapolate.

Unfortunately this is as far as we’ll go for now.

Overlap in Traits

My anecdotal evidence talking to dozens of rental property investors points me towards that 50% estimate.

Simply listing the characteristics of an engineer and a rental property investor also point us towards significant overlap. The stereotype of both are nearly identical.

Both are good with numbers, logical, and prefer tangible things they can touch (as compared to options trading or theoretical physics).

How many people are good with numbers? Comfortable with math? I bet shockingly low. That trait alone is likely highly correlated with engineers and rental investors.

What about you?

Help me gather a bit more data.

I know what it is like to be an internet lurker, but this time, actually leave a comment!

Do you have any rental properties? How about an engineering background (even if not employed as an engineer)? What would you estimate is the overlap between rental property investors and engineers?