Are you someone who misses the good ol’ days?

I recently met up with a college friend I hadn’t seen in 7 years. He asked me if I missed the college days.

No.

I had the best college experience of nearly anyone on the planet. My four years at Stanford were perfect. A much welcomed academic challenge, unreal freedoms not seen at other universities, athletic achievements well beyond expectations, and incredible long-lasting friendships.

Yet I don’t sit and wish I could go back in time. I appreciate it, but don’t long for it.

The housing market is always changing as well. And many more people are warming to the idea of selling their home quickly for cash, with somewhere like The Buy Guys, (click here for more information) instead of going down the conventional route of finding the best real estate agents who can take on the role of selling their home.

Are you an investor who longs for the good ol’ days or takes advantages of today’s opportunities?

Interest Rates Are Going Up

This week the Federal Reserve raised the key interest rate a quarter of a point. And they said they are expecting to do it a couple more times in 2017.

What does this mean?

Honestly not a whole lot. In my opinion the Federal Reserve has become more reactionary, bending to the will of the market, rather than setting the market.

A quick look at a chart of the 30 year mortgage rate will tell you more. This is different than the Fed Rate, but they are all related somehow.

At the beginning of November the rate was 3.5% and now it is 4.1%.

Wow, that is quite a jump. How does that affect a mortgage payment?

For instance, when people contact a mortgage company with the net branches, the loan officer can hire other originators who will work directly for them. Customers who are looking for good mortgage loan deals will benefit from this as well.

It also allows the net branch manager to conduct business as a separate entity while remaining protected by a mortgage banking organization, which may benefit customers in other cities as well. Higher mortgage rates, on the other hand, may have an impact on the cost of purchasing a home.

From $405 per month to $434 a month for the type of property I invest in. ($100k purchase price, $80k mortgage, assuming the investor rate is 1% higher than the home owner rate.)

Ouch. If you purchased in October you would have had an extra $350 in cash flow a year.

Ya But…

Rates are historically low still. Even if we aren’t at the very bottom, it looks like a pretty good deal when you zoom out.

The biggest “ya but” is that everything is related. We shouldn’t just look at one number, the interest rate, and jump to a conclusion.

Higher interest rates indicate there is more inflation. As a leveraged rental property investor, inflation is where you make an absolute killing (see Inflation: The Great Mortgage Destroyer).

Higher interest rates will also affect all the other numbers we care about. Without getting too into the weeds, a larger monthly debt payment might soften the purchase price to counterbalance. Rents might rise as the expense gets passed through to the tenant. This means a stronger rent to value ratio.

There are many ways to win the game, we just have to adjust our strategy accordingly.

Appreciating Today’s Opportunities

It is important to have the right mindset. Rather than longing for the good ol’ days when you could get an incredible interest rate, appreciate today’s opportunities.

My mindset is to always be buying, not waiting for the perfect situation that may never come. Just adjust what you are doing.

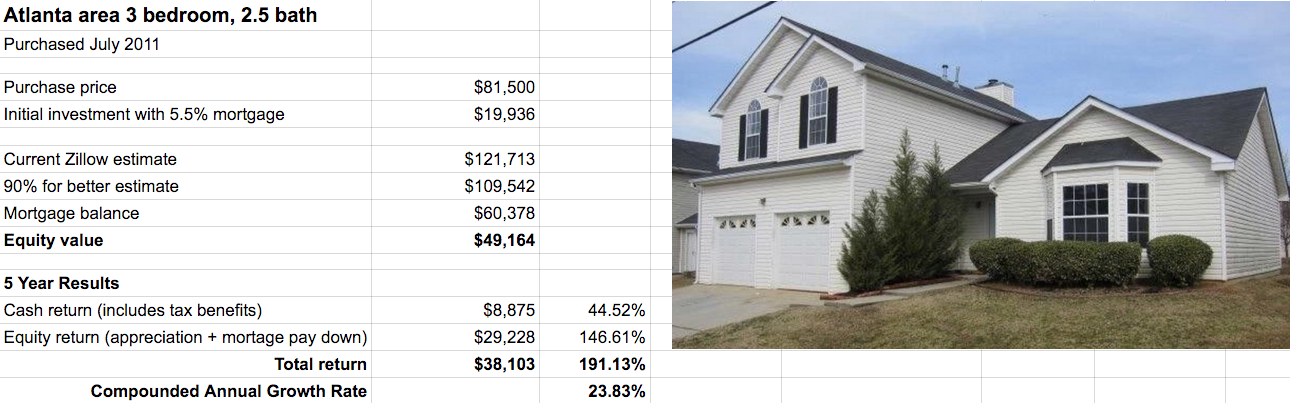

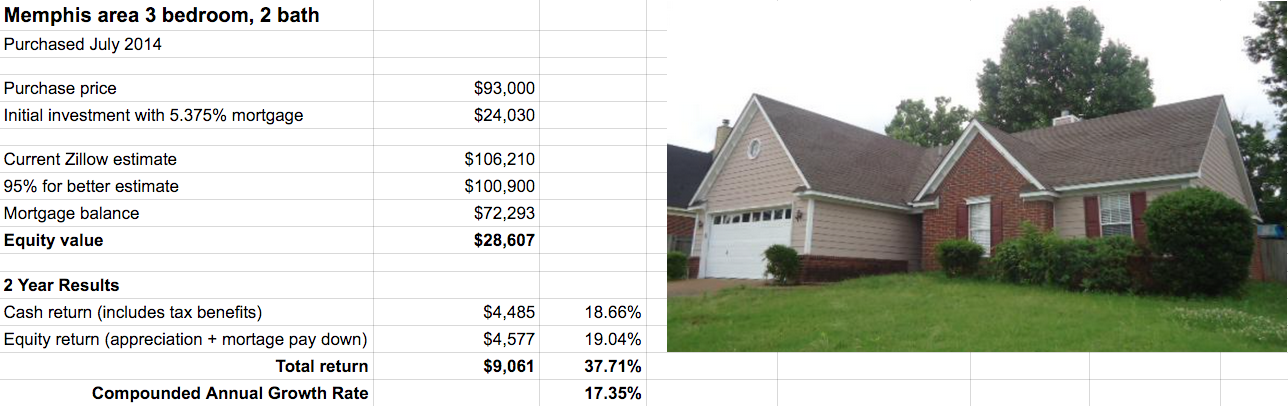

I wouldn’t buy in San Francisco right now. Maybe not even Atlanta. But Memphis or Kansas City? Sure.

I want to avoid being one of those investors who wishes he bought earlier.

What do you think? Do higher interest rates make you less willing to get a rental property? How does it affect your strategy?