If there is one thing people don’t have an intuition for, it’s Einstein’s Theory of Relativity.

So you’re telling me that the speed of light is the same no matter what speed I’m going? So if I’m standing still it’s X and if I’m traveling the exact same direction as the light, going X speed myself, somehow the light is still traveling away from me at speed X?

So you’re telling me that time itself changes based on the observer? So if you have two twins, and one leaves earth to travel around the galaxy for a while at the speed of light, when he comes back he is somehow younger than the other twin?

Ya sure … sounds a little fishy to me. But ok, whatever you say Mr. Genius.

If There’s One More Thing People Don’t Have an Intuition For, It Is Compound Interest

In fact, Einstein himself might have pontificated on this (or maybe not).

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.

-Albert Einstein

Compound interest works both ways whether you are lending or borrowing. Another form of compound interest is inflation – something everyone is affected by whether you know it or not.

How can we get these powerful forces to work for us rather than against us?

I believe the best way is to have a mortgage balance that someone else pays off. Alternatively, people can look on websites such as https://www.housebuyersofamerica.com/how-to-get-out-of-a-mortgage for more information on mortgages. More on that soon.

Inflation Over 30 Years

It is hard to comprehend how inflation destroys the purchasing power of the dollar over a long time horizon. But let me try to put it in perspective.

The rule of 72 is a shorthand way to estimate how long it takes for compound interest to double. You just divide 72 by your interest rate and that is the number of years it will take to double.

If we estimate an inflation rate of 4.8%, then in 15 years the purchasing power is cut in half. In another 15 year it is cut in half again. So in 30 years, things would be 4 times more expensive.

In other words, in 30 years a ticket to Disneyland will be approaching $500! Hopefully your paycheck keeps up over those 30 years as everything else will be more expensive too…

Maybe 4.8% is a little high to forecast for inflation over the next 30 years, but that is a discussion for another day.

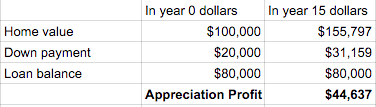

Let’s look at a more generally accepted inflation rate of 3% over the course of 15 years. I think 15 years is about as far as people are comfortable projecting – that could be your target retirement, or when your toddler will head off to college.

$1 in 15 Years Has the Purchasing Power of 64 Cents Today

Inflation slowly destroys the value of the dollar. Even at just 3% per year, with a pretty long time horizon and the compounding effect, it is significant.

Or put another way, you would have to invest 64 cents today at 3% interest to get a dollar 15 years from now.

Notice that I’m not using some wacky high inflation numbers or time horizons. Yet when we go through the numbers for a rental property it yields some impressive results.

Fixed Monthly Mortgage Payments

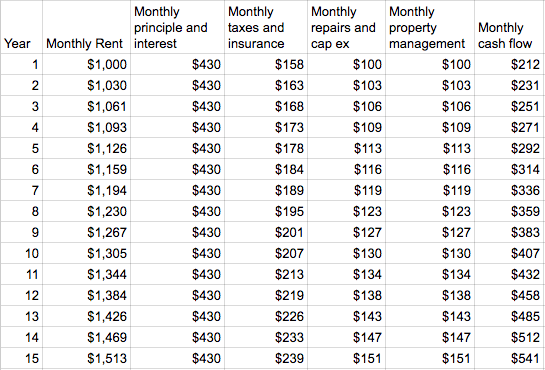

Let’s imagine I purchase a $100k property with 20% down at a 5% interest rate 30 year mortgage. It rents for $1000 a month – pretty much exactly the same as the two properties I currently own.

My monthly principle and interest payments on that mortgage will be $430. The real shocker is it will be the same $430 payment every month for 30 years.

It never goes up! Over time this payment will feel smaller and smaller. Let’s look at some numbers:

In the first year, this principle and interest payment is 43% of the rent collected. Every year inflation will tick up the monthly rent, taxes, insurance, repair expenses, and property management fees. Yet the principle and interest payment stays the same.

After 15 years the monthly rent is $1513. The principle and interest payment is now just 28% of the rent collected!

With every passing year, the mortgage payment is easier and easier to make. And since it is fixed while our rents are rising, you’ll notice in the far right column, our monthly cash flow goes up.

What About the Mortgage Balance?

The mortgage payments are fixed and over time the tenant is paying down the mortgage for you. Your cash flow is going up, the mortgage balance is going down, and the value of the dollar is going down as well.

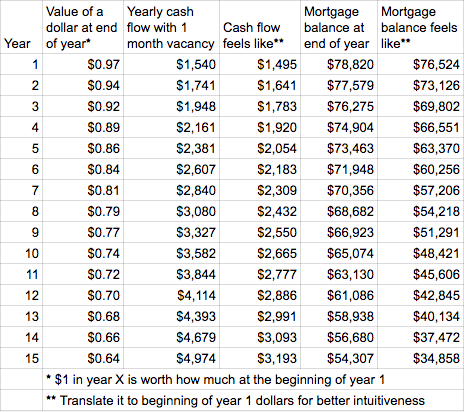

Let’s look at the numbers year by year:

At the end of year 1, we receive $1,540 in cash flow. But the value of the dollar is 3% less due to inflation, so is equivalent to $1,495 at the beginning of the year.

The tenant has paid down the mortgage balance a little bit for us. It is now at $78,820. But here is the crazy thing – at the end of the year the mortgage balance is also easier to pay thanks to inflation. To help your intuition on this, we can translate that loan balance to what it would feel like at the beginning of year 1: $76,524.

Do this for 15 years and where do we stand?

$1 in 15 years is equal in purchasing power to 64 cents today. Our yearly cash flow has gone all the way up to $4,974 (remember it increases due to the fixed principle and interest payments with rising rents and expenses) – or translated into today’s purchasing power it is $3,193. The purchasing power from the cash flow has more than doubled!

In 15 years the mortgage balance stands at $54,307, which the tenants have been kind enough to pay it down for us. But that $54k doesn’t seem as significant when inflation has raised the prices of everything. Translated into today’s purchasing power, it is equivalent to just $34,858!

Inflation is the Great Mortgage Destroyer

Prices keep rising, the mortgage payment stays the same. The mortgage payment is easier and easier to make and the mortgage balance feels less and less significant. Thus, if you feel like you should look for homes and would opt for a mortgage payment system for it, you could look at lenders similar to a Mortgage Broker Colorado who can help you out!

If you can master the concepts of compound interest and inflation, you can use them to your advantage.

There really aren’t any other opportunities where an average Joe has the ability to borrow money like this and return a cash flow. The fact that you can go get an extremely reasonable rate for an investment mortgage is frankly amazing, whether you get one to purchase a property in your own country or consult with someone like simon conn with a view to buying a property overseas to let to holidaymakers. It is a gift everyone should take advantage of. However, if you are simply a military veteran after an affordable mortgage so you can own your home then it might be worth using this mortgage calculator.

All you have to do is sit tight while the tenant pays down the mortgage for you and inflation does the rest.

What are your thoughts? Do you understand how powerful a mortgage destroyer inflation is? What’s holding you back from taking advantage of it?

If you are interested in playing around with the numbers yourself, here is the spreadsheet I used.