I found a twenty dollar bill on the ground this week in Golden Gate Park.

Guess what I did?

I PICKED IT UP!

I didn’t assume it was too good to be true – that it wasn’t real otherwise one of the homeless people would have picked it up already.

I didn’t assume it had feces on it rendering it way less appealing than a normal $20 bill.

And I certainly didn’t fixate on the downside of bending over to pick it up, hurting my back to the tune of a $5k hospital bill and an irreparable life-long injury.

Yet these are the kinds of excuses you hear from people about investing in rental properties.

Extremely smart people state that the risk is priced in to rental property returns and explore no further.

What’s at Stake

This isn’t a matter of finding $20. This is your financial well being, whatever that means to you – retiring early, paying for your kids college, exotic vacations, you name it.

We will thoroughly dig into numbers in Part 2, but I believe you can expect over a 25% yearly return on low cost rental properties.

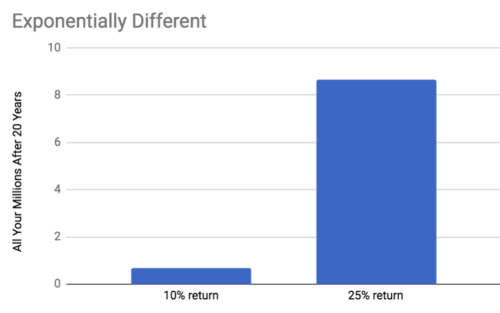

Humans don’t have great intuition when it comes to exponentials. You’ve probably heard the “how thick is a piece of paper folded in half 100 times?”

Investment returns are exponential as well. So instead of intuition, let’s visualize what is at stake.

Let’s compare investing $100k in the stock market with a generous 10% yearly return vs 25%, over 20 years.

That’s a huge difference! $673k vs $8.7M.

If there is one time to not be intellectually lazy, this is it. So let’s take a closer look.

Is the Risk Priced In Rental Property Returns?

When someone says the risk is priced in, they are stating that the reason the returns are greater is because it is balanced out by the risk of losing money.

Imagine a roulette wheel with 36 numbers and no zero. Betting on red, black, even, or odd pays 2 to 1. Betting on a single number pays 36 to 1.

Of course betting a single number has much greater returns, let’s bet there!

Not so fast bucko – it comes with more risk. You will lose so often that it balances out – your expected rate of return is exactly the same as betting red.

Back to rental properties. If you state the risk is priced in without calculating anything, you are stating a belief in the efficient-market hypothesis.

What is the Efficient-Market Hypothesis?

Without getting too technical, it states that all information is priced in relative to risk in an efficient market.

The $20 bill intro ran through some comedic extrapolations of the efficient-market hypothesis.

In other words if I see something that is too good to be true (free $20) in an efficient market (out there in public), there is either information I’m missing that others know (feces) or risk I’m not accounting for correctly (hurt back).

You could state that I had an information advantage – I saw the $20 bill. The whole market didn’t have access to that information, just me.

In other words, believers in the efficient-market hypothesis think it is possible to generate higher returns accounting for risk, but you need some sort of advantage.

I challenge you to not be mentally lazy and just assume the risk is perfectly priced in to rental property returns. Here are some of the advantages that let you generate greater returns.

Advantage 1 – Your Effort

It is a pain in the butt purchasing real estate.

You don’t just go on E*TRADE and a few clicks later have your $20k invested.

No no no – it takes at least a month involving piles of paperwork and lawyers. However, if the Real estate loan is sanctioned at the earliest or the respective party has the required funds with them, the process could be relatively simpler. Also, the good news is it has been done many times and is fairly mechanical after you have done it once.

But the really good news is that this keeps people out. Their laziness is your gain.

Advantage 2 – Government Encouragement

A tax code and other policies are basically a set of incentives designed to encourage certain actions from the populace.

The US government encourages individuals to own rental properties by handing out free money. It’s up to you to take advantage of it.

There is obvious tax stuff like deductions on real expenses like interest payments and fake expenses like depreciation.

Even better – a whole government agency is set up to provide cheap leverage to investors. Leverage is how you can achieve such incredible returns. (And it can be safe. Not trying to time a market like Miami, rather going for slow and steady boring cities with jobs like Memphis. See: The Thing Most Investors Don’t Understand About Leverage)

Usually only banks and big corporations have access to investment leverage like this. This is the one area an Average Joe can do it. Wahoo!

It is way affordable too. The interest rate on a credit card is around 20%. If you get a personal loan or a small business loan, I doubt you can find under 10%. And you’d have a max of 5 years to pay that back.

On a rental property it is only 5% and you have 30 years to pay it back. Isn’t that absurd in comparison?

Advantage 3 – It Isn’t an Efficient Market

The US real estate market is pretty decent at sharing information. There are things like the MLS and clear ownership through deeds.

But it isn’t perfect.

The main disruption to the efficiency is foreclosures. If someone can’t pay their bills, they get kicked out of the home and suddenly the bank owns the property. The bank doesn’t want to own a rental property (see #5 for why), so they get rid of it as fast as possible at a discount.

Other disruptions are properties that require a lot of work, which limits the willing buyers and drops the price even more than the repairs will cost. Or people who for whatever reason don’t want to go through the long 60+ day regular process of selling a home and want to unload it for cash now. This is easy to do if you use companies like Elite Home Solutions who can Sell Your House Fast in Raleigh, NC, although there are many places that offer this service in other areas across the country. Other methods are to flip homes to speed up this selling process.

There are people more than willing to take advantage of this. They put in the work to discover the deals, do the repairs, and flip it to someone like me.

Thanks to the inefficiencies in the market, everyone is happy!

Advantage 4 – Patience is Rewarded

The time frame of most investments is incredibly short.

The stock market is all about quarterly earnings. The long-term investment firms of VC and private equity are max 7 years.

In order to get the best value for your investment, it is definitely recommended that you get in touch with a professional like Lincoln Frost who has the utmost experience when it comes to private equity.

Why is it important? Well, you are building wealth to retire decades from now.

Is that an advantage? Perhaps, especially if it keeps others away.

The expected return after 1 year of a rental property is likely negative, considering the closing costs and tenant placement expenses. It just isn’t a good option to exit the investment after 1 year.

After 5 years? Maybe. But that might be more of a crap shoot on market timing and the transaction costs are still a significant chunk of the profits.

You really have to be in it for the long-haul and willing to ride out the whole cycle.

I bet you can – aren’t you investing in a 401k or IRA that you can’t touch until you are 59.5?

Advantage 5 – It’s Small Bananas

If you remember only one advantage, this is the one.

Sophisticated investors take advantage of market inefficiencies and use them to their advantage.

The return vs effort on single family home investments is great for your personal portfolio, but insignificant for a large fund with millions of dollars.

It takes too much effort that makes it impossible to invest their entire fund in rental properties. And even if they can get a 30% return on just 1% of their portfolio, that still isn’t worth their effort.

A big shot portfolio manager won’t spend his time picking up pennies, even if it is free money.

It just doesn’t scale.

Perhaps it was a little disingenuous of me to show a chart earlier climbing 25% per year all the way to $8M. When you have over say $500k invested, the simple single family home strategy will have to change. The potential returns are lowered when leverage is reduced.

What a great problem to look forward to!

Don’t Take My Word For It, Calculate

I hope this article makes you reconsider your assumption that the risk is priced in rental properties’ amazing returns.

We looked at 5 potential advantages that you have, even if it is an efficient market.

But we didn’t put numbers to it. How much of the return is simply the priced risk? How much of it is market inefficiencies?

In Part 2 I am going to run some numbers to try to answer that question.

Yet it won’t matter one smidgen if you don’t first believe:

- The stakes are important enough for you to spend brainpower on this

- There are theoretically advantages you have even without any real estate experience

So let’s discuss – leave a comment below and let me know what you think.