Well how do you like that?

I like it just fine because my rental properties are humming along nicely. In fact, by my calculations I made $8061 in cash flow in just the last 6 months.

Let’s take a look!

A Quick Look Back

I am the proud owner of 3 properties I have never seen that are located thousands of miles away.

Here is how it went down:

- July 2011 – Bought Atlanta area property for $20k investment

- July 2014 – Bought Memphis area property for $24k investment

- May 2017 – Cash out refinance on Atlanta property to pocket $36k (why and details)

- September 2017 – Bought Memphis area property for $26k investment (search and details)

I think of my portfolio as a snowball gaining 30% more mass each year – yes, I am getting a 30% a year return. My role is to keep it moving with as little as work as possible. I’m pretty hands-off.

Added together, my property managers now collect $3185 in rent each month. My mortgage payments total $1918. With ~10% to the property manager, I’m clearing $950 a month in cash flow if all goes well!

Let’s drill down and look at each individual property.

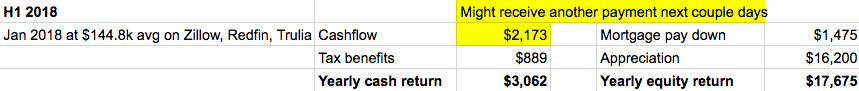

Rental #1 Numbers – Atlanta

Just crushing it on the appreciation!

I took the average of Zillow, Trulia, and Redfin – according to those estimates this property along appreciated $16,200 in 2018. Wow.

These returns are pretty impressive, but they are largely on paper (excluding my cash out refinance). You see, when the market turns over the next couple years, some of the appreciation will quickly disappear. That’s ok because there is more to real estate – don’t forget about the cash flow!

The cash flow is back up too. The tenant has been in there for the full 7 and a half years I have owned it, which is great news, but unfortunately they fall behind on rent occasionally.

In 2017 they were behind, so 2018 when they got caught up, my cash flow numbers are doing great!

24.4% compounded annual growth – bada bing, badda boom!

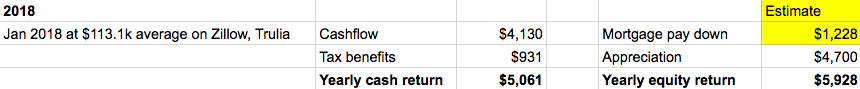

Rental #2 Numbers – Memphis

Steady Eddie.

Appreciated another $2300 over the last 6 months. The best cash flow of any property at $4131.

Oh and I haven’t mentioned a couple other categories too – the tenant paid down the mortgage for me $1228. And I received another $931 in tax benefits according to my calculations (long story, see previous articles).

The all-star property #1 purchased at the depth of the recession has a 24% compounded annual growth rate over 7.5 years. Well this one isn’t too far behind: 21% CAGR over 4.5 years!

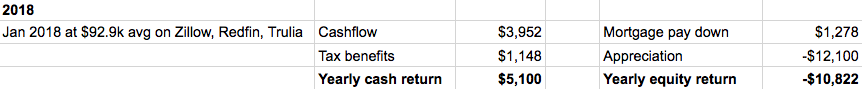

Rental #3 Numbers – Memphis

Ok you ready for a dud?

According to 2 of the 3 price estimating websites, this one dropped a ton in the last 6 months. Why? I have some ideas…

First, these are quick estimates. You really have to look at comps to get an accurate price estimate. Luckily, those websites include some nearby “recently sold” properties…

And those time seem to indicate normal prices. One a block away for $125k, not $83k…

You essentially have two drastically different property prices in the area – old ones with no work done over the years or flipped properties. Any flipped property that had a ton of work done will have a higher price tag (like mine).

My best guess is there is some ~1 year period where the last sold price really sets the price estimate. So I don’t believe there is anything drastically different now!

I’ll go with those numbers anyway. Down $12k in price, $4k in cash flow. Ouch.

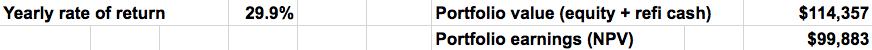

Overall Portfolio Numbers

Despite the big drop in Rental #3, the numbers are great.

Compared to 6 months ago, my portfolio yearly return dropped from 30.1% to 29.9%. I’ll take it!

Net present value just hit $100k. That is impressive. Basically this is the amount OVER a “100% safe” investment like a CD returning 2% every 6 months (which is still better than you’ll actually find in a CD despite interest rates jumping up recently).

That is incredible to me. It certainly is worth the minimal effort it takes to learn this stuff, acquire the properties, and the occasional phone call.

Here is the half year cash flow breakdown:

The Highest Highs

I know I shouldn’t get too excited though – I’ve caught 7.5 years of a huge bull run of the market. I’m not a genius investor.

Let’s say I have a paper “drop” in value of 30% on my property values overnight. That should would suck, but I’d keep the properties and they would still cash flow.

What would that do to the numbers? Instead of a 29.9% yearly return, it would drop all the way down to 9% per year. Temporarily. And if it took a year to drop 30%, but with the other benefits of cash flow, paying down the mortgage, and tax benefits? 12% yearly return.

That’s better than what people expect out of the stock market! Then things will be back on the upswing before you know it, again raking in huge returns.

Not too shabby. What do you think?

Other Updates from Brian

I’ve been keeping busy with my other ventures, so not much action or plans for Rental Mindset for now. So rather than doing the typical email opt-in for extra content, I’ll just share the link to my full spreadsheet for the above calculations.

What have I been spending my time on? I still have my day job of kids coding tutoring and then spent much of 2018 creating an app in the environmental space. It is called Pledge Balance – the basic idea is that a lot of people care about the environment but don’t have a simple action to take. It is a pledge to balance the negative impact of your driving and flying with a tiny payment that goes 100% to the ?. My drive today was 17¢ to balance, which is invested in projects like planting ?. Just launched in beta for iOS, so I’m excited to see where it goes!