It’s official – I’m the proud owner of my third rental property!

A mobile notary came over to my house last Friday with a huge stack of papers for me to sign. I’d heard about these types of mobile notary support services washington d.c. and those that are similar before, and they are all highly regarded in the eyes of law firms and others when important documents need to be signed as soon as possible. It tends to happen when lawyers find themselves under time pressure and they can’t get the job done themselves. Although, as long as it gets done, I don’t think it matters who does it. They’re all on the same side after all. That drew to an end a surprisingly long 95 days since my verbal commitment to the seller.

No, the slow part wasn’t the notary… The assumption is that the notary is what makes it a tedious process but as long as you go to a mobile notary in the Los Angeles area (or the one in Washington) like Rachel Mintz did, then the process shouldn’t take too long.

Recapping the Deets

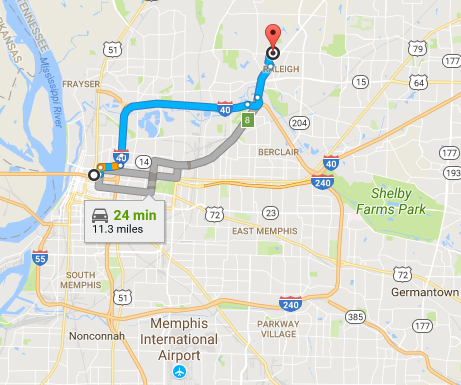

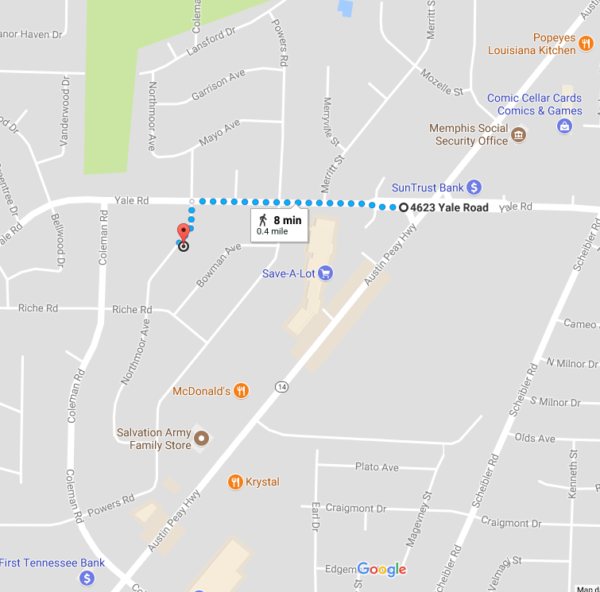

It is a big 5 bed, 2 bath in a Memphis suburb. Purchased for $105k should rent for $1100.

Details on finding the property: How I Locked Up My Third Rental Property Investment

Here is the after rehab video:

What Took So Long?

The appraisal.

It started with a request from me in late July that the lender hold on ordering the appraisal. I wanted to make sure the rehab work was finalized, but I made a couple mistakes.

I thought I was delaying the appraisal and inspection, but the inspection had already been ordered. Ooops. The inspection and appraisal helped to value the house and ensure it was in good enough condition. Thankfully, we had sorted most of the problems. Before starting the job, we had checked for any signs of pests by contacting https://www.pestcontrolexperts.com/, so we knew the house was clean and hygienic.

The rehab was almost finished, so I just wanted to wait another few days. I thought there was still plenty of time before our original target closing date of mid-August.

I wasn’t exactly on top of things though. My wife and I went from a Flagstaff family reunion, to Chicago to celebrate my mom’s 60th birthday, to Bigfork Montana for a wedding. During the two week trip, real estate wasn’t always top of mind.

A week and a half went by before the bank reached out and said “can we order the appraisal?” I said “oops, go ahead”.

The Appraisal Process

Turns out I shouldn’t have delayed anyways because appraisals are slow going these days. I assumed it would have been like the last purchase I made in 2014. Given the tons of home sales in 2017, it wasn’t.

I should have read:Turnkey Rentals in 2017: Why You Need to Adjust Your Approach

One of the issues that led to the financial crisis was appraisers weren’t exactly independent. Banks could choose who they used, going with appraisers who would do whatever the banks wanted – essentially always quickly giving back a good valuation.

Now there is an intermediary. The lender puts in a request to a separate appraisal scheduling company (who I will refer to as “the appraisal desk”). This company has a pool of appraisers they use, and assign someone without the bank being involved.

That’s great and all, but boy did it slow things down! My lender’s communication with this outsourced appraisal desk was like a game of telephone: slow and unreliable.

Here’s what happened:

- I delayed the start 1.5 weeks accidentally

- Appraisal is ordered and it takes 1 week for appraiser #1 to call the seller to schedule

- The seller rejected the appraiser after he supposedly said he doesn’t use rentals as comps, so he requested it be reassigned to a new appraiser

- Another week goes by before appraiser #2 reaches out

- Appraiser #2 calls the seller and leaves a voicemail. Then he tells the appraisal desk he is too busy for the job, so turns it down.

- That same day the seller calls appraiser #2 back and he agrees to take the job. They schedule a date and just have to let the appraisal desk know it’s back on.

- The appraisal desk never gets back to him before the scheduled appraisal date, so appraiser #2 cancels the appointment

- Meanwhile it has been assigned to appraiser #3, but it took another week for him to call and schedule for a week out

- Appraiser #3 turns in the report to the appraisal desk, but there are unknown delays. Maybe they wanted to replace a comp or two?

- Two weeks after the initial appraisal was submitted, I get a copy

- Closing is scheduled for 1 week later

What a mess!

It would have been so much easier if the appraisal desk had simply kept with appraiser #2 and replied to his emails. It seems like there was a 1 week delay any time someone contacted the appraisal desk. Maybe emails are printed and delivered by pony express?

Throughout this I was talking to my two contacts (seller and lender), trying to facilitate communication between two other people (appraisal desk and appraiser).

When the mess with appraiser #2 was happening, my lender said: “You are way more involved at this point that 99% of buyers.”

To which I replied: “That’s because I’ve lost confidence in your chain of communication and ability to get this done.”

In the end, the appraisal came back as expected ($105k) and everything was a go.

What Did I Learn?

Sometimes things don’t go as planned…

Just like working with a property manager, I found myself working the lender to instill a sense of urgency. If they had a task to take care of, I was making daily phone calls.

One of my take-aways is that the lender isn’t the only person I needed to worry about – whoever they outsource the appraisals to is important as well. I’m not sure I could have known this ahead of time, but I sure didn’t feel there was a good enough channel of communication between them. Or that the lender was on my side and hustling enough. When it comes to selling a property, I may prefer a buyer who can buy my property as fast as possible (click https://webuyhousesinatlanta.com/ for more information) rather than putting it out on any website and waiting for homebuyers to reach out to me.

So next time I’ll probably go back to the lender (#1) I used on my first two properties (the refi was also through lender #2). It was a tiny more expensive, but worth it.

I also learned that I shouldn’t assume I know everything just because this is my 3rd rental property. It wasn’t exactly the same as last time and I made a small mistake because of it (while distracted with my personal life).

Fresh eyes with a beginner’s mindset next time.

All Good Now

The seller could have backed out and found another buyer since it was beyond our initially agreed upon window. Or the appraisal could have finally come back too low.

Even though it took a while, everything worked out in the end. So all things considered, waiting a bit longer is no big deal!

I want to hear from you – have you had any surprises during a rental property closing process? Did it work out in the end?